Get La Lwc 4bc 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LWC 4BC online

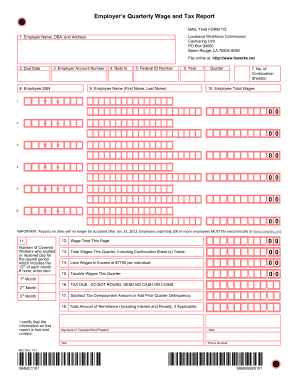

The LA LWC 4BC is the Employer’s Quarterly Wage and Tax Report required for reporting wages and taxes for employees. This guide will walk you through each step of filling out the form online, ensuring that you understand how to provide the necessary information accurately.

Follow the steps to fill out the LA LWC 4BC online.

- Click the ‘Get Form’ button to access the LA LWC 4BC form online.

- In section 1, enter your employer name, doing business as (DBA) name, and your address. Ensure that this information is clear and matches your official records.

- In section 2, input the due date for the filing. Be mindful of deadlines to avoid penalties.

- Section 3 requires your employer account number. Ensure this number is entered correctly for accurate identification.

- In section 4, state the applicable tax rate for your business. This is essential for calculating the tax due correctly.

- In section 5, provide your federal identification number to comply with federal reporting standards.

- In section 6, indicate the year for which you are reporting wages and taxes; this helps maintain organized records.

- Section 7 asks for the number of continuation sheets you will attach if there are more than six employees to report.

- In sections 8 to 10, for each employee listed (up to six), provide their social security number, the total wages paid, and their full names. Round totals to the nearest dollar as instructed.

- In section 11, enter the total number of covered workers who were paid during the included payroll periods.

- Calculate the total wages on the page and record this amount in section 12.

- In section 13, include total wages for the quarter from each continuation sheet attached, if applicable.

- For section 14, enter the wages paid in excess of $7700 per individual for the quarter, if any.

- Section 15 requires you to calculate the taxable wages for the quarter, taking care to follow any requirements for prior excess wages.

- In section 16, note the total tax due without rounding. Make sure to verify accuracy.

- If applicable, enter any tax overpayment or prior delinquency in section 17 to adjust your total.

- Finally, in section 18, state the total amount of remittance required, including any interest or penalties.

- Sign and date the report in the certification section, providing your title and phone number before submission.

Complete the LA LWC 4BC online to ensure compliance with reporting requirements.

In Louisiana, several factors can disqualify you from receiving unemployment benefits. These include voluntarily quitting your job without good cause, being discharged for misconduct, or failing to meet work search requirements. Understanding the specific disqualifications can help you navigate your eligibility. If you need assistance with the appeal process, consider using LA LWC 4BC resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.