Loading

Get La Ldr Cift-620ext-v 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR CIFT-620EXT-V online

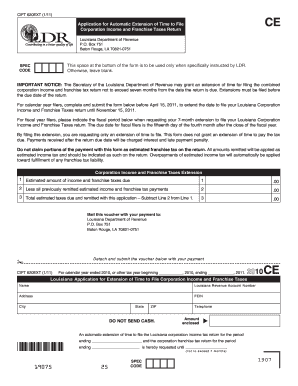

The LA LDR CIFT-620EXT-V form is used to request an automatic extension of time to file corporation income and franchise taxes with the Louisiana Department of Revenue. This guide will help you navigate the process of completing this form online with ease.

Follow the steps to fill out the form successfully.

- Press the ‘Get Form’ button to access the form and open it in your online document editor.

- Begin by entering the calendar year or tax year in the designated section for the period you are requesting an extension.

- Provide your corporation's name, Louisiana revenue account number, and federal employer identification number (FEIN) in the appropriate fields.

- Fill in your corporation's mailing address, including city, state, and ZIP code to ensure proper correspondence.

- Indicate the telephone number for your corporation, so the Louisiana Department of Revenue can contact you if necessary.

- Complete the estimated amount of income and franchise taxes due. This is crucial as it determines any payments needed with your extension request.

- Subtract any previously remitted estimated tax payments from the total estimated taxes due to find the amount you need to remit with this application.

- Once you have filled out all required fields, review your information for accuracy and completeness.

- Save your changes and proceed to download or print the completed form as needed for submission.

- Mail the completed voucher with your payment to the Louisiana Department of Revenue at the specified address, and ensure it is sent before the original due date.

Complete your documents online today for a seamless process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Virginia does grant automatic extensions for individuals who file for one. However, you must still file the necessary documents, such as the LA LDR CIFT-620EXT-V if applicable. This is important to ensure you don’t face any late fees. Uslegalforms can provide the resources you need to manage this process smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.