Loading

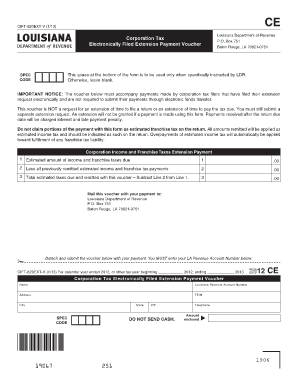

Get La Ldr Cift-620ext-v 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LDR CIFT-620EXT-V online

Filling out the LA LDR CIFT-620EXT-V is essential for corporation tax filers requesting an extension. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form successfully.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your Louisiana Revenue Account Number in the designated field. This is crucial for identifying your account with the Louisiana Department of Revenue.

- Fill in the 'Name' field with the legal name of your corporation, ensuring it matches the registered name with the Louisiana Department of Revenue.

- Provide the 'Address' of your corporation, including street, city, state, and ZIP code. It is important that this information is current and accurate.

- In the 'FEIN' section, enter your Federal Employer Identification Number. This unique identifier is necessary for tax purposes.

- Move to the 'Estimated amount of income and franchise taxes due' field and input the total estimated taxes your corporation expects to pay.

- In the 'Less all previously remitted estimated income and franchise tax payments' section, enter any payments you have already submitted to reduce the total due.

- Calculate the 'Total estimated taxes due and remitted with this voucher' by subtracting the previous line amount from the estimated amount due. This amount should accurately reflect what you are submitting with the voucher.

- Ensure that the voucher is attached to your payment and clearly indicate the amount enclosed in the appropriate field. Do not send cash.

- After reviewing all your entries for accuracy, save changes, and keep a copy for your records. You may also choose to print or download the completed form before sending it to the Louisiana Department of Revenue.

Complete your documents online and ensure accurate and timely submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, requesting a tax extension online is a convenient option available to taxpayers in Louisiana. By using the LA LDR CIFT-620EXT-V form, you can seamlessly extend your filing period without the hassle of paper submissions. This digital approach not only expedites the process but also secures proper documentation of your extension request.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.