Get Ky Dor 51a126 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

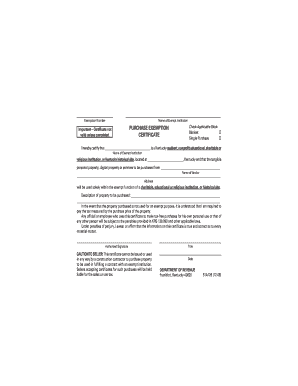

Tips on how to fill out, edit and sign KY DoR 51A126 online

How to fill out and sign KY DoR 51A126 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Reporting your income and submitting all necessary tax documents, including KY DoR 51A126, is the sole responsibility of a US citizen.

US Legal Forms simplifies your tax handling, making it more accessible and efficient.

Keep your KY DoR 51A126 secure. Ensure that all relevant documents and records are organized while adhering to the deadlines and tax regulations set by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Access KY DoR 51A126 through your browser from any device.

- Click to open the editable PDF file.

- Begin completing the template field by field, following the cues of the advanced PDF editor's interface.

- Accurately enter text and figures.

- Choose the Date field to automatically insert today's date or modify it manually.

- Utilize the Signature Wizard to create your unique electronic signature and sign in seconds.

- Refer to the Internal Revenue Service instructions if you have further questions.

- Press Done to preserve the updates.

- Proceed to print the document, download it, or send it via Email, SMS, Fax, USPS without leaving your browser.

How to alter Get KY DoR 51A126 2009: personalize forms online

Choose a trustworthy document editing solution you can depend on. Modify, complete, and sign Get KY DoR 51A126 2009 securely online.

Frequently, modifying forms, such as Get KY DoR 51A126 2009, can be difficult, particularly if you received them digitally but lack access to specialized applications. Naturally, you can use certain alternatives to bypass this, but you may end up with a document that does not meet the submission criteria. Employing a printer and scanner isn’t an escape either, as it consumes time and resources.

We offer a more straightforward and effective approach to completing documents. An extensive library of document templates that are easy to personalize and authenticate, and make fillable for others. Our platform goes far beyond just a collection of templates. One of the greatest features of our solution is that you can modify Get KY DoR 51A126 2009 directly on our site.

Being a web-based service, it prevents you from needing to download any software on your computer. Moreover, not all corporate policies allow you to download it on your work computer. Here’s how you can quickly and securely finish your documents using our tool.

Eliminate paper and other ineffective methods for executing your Get KY DoR 51A126 2009 or other documents. Use our tool instead that features one of the richest libraries of customizable templates and a robust document editing solution. It’s simple and secure, and can save you a lot of time! Don’t just take our word for it, try it yourself!

- Click the Get Form > you’ll be redirected to our editor instantly.

- Once opened, you can start the editing process.

- Select checkmark or circle, line, arrow, and cross among other options to annotate your document.

- Choose the date option to add a specific date to your template.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to include fillable fields.

- Select Sign from the top toolbar to create and attach your legally-binding signature.

- Click DONE and save, print, share, or download the document.

Related links form

To fill out a title reassignment, locate the reassignment section on the back of the vehicle title. Enter the buyer's information, description of the vehicle, and any required details about the transaction. Both seller and buyer need to sign the document for it to be valid. Make sure to adhere to the steps outlined in the KY DoR 51A126 to avoid any processing issues.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.