Loading

Get Irs 1120-f - Schedule M-1 & M-2 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F - Schedule M-1 & M-2 online

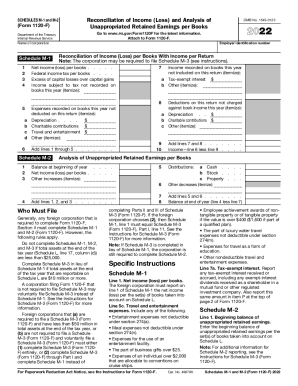

This guide provides step-by-step instructions for completing the IRS 1120-F - Schedule M-1 and M-2 forms online. These schedules are essential for foreign corporations reconciling income and analyzing unappropriated retained earnings.

Follow the steps to accurately complete Schedules M-1 and M-2.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Schedule M-1 by entering the net income (loss) per books on line 1, based on the corporation's financial records.

- Input any federal income tax per books on line 2. Ensure this amount matches your records.

- Detail any excess of capital losses over capital gains on line 3, if applicable.

- List any income subject to tax not recorded on books this year on line 4, making sure to itemize each source.

- Enter deductions on the return that were not charged against book income on line 5, itemizing each deduction.

- Record any expenses recorded on books this year but not deducted on the return on line 6, detailing each item.

- Add lines 1 through 6 to get the total income on line 7.

- Proceed to Schedule M-2 and enter the balance at the beginning of the year on line 1.

- Report the net income (loss) per books on line 2 and list any other increases on line 3.

- Sum amounts on lines 1, 2, and 3 to complete Schedule M-2.

- Once completed, save your changes, download, print, or share the form as needed.

Start filling out your forms online today to ensure compliance and accurate reporting.

Any entity that files Form 1065 must file Schedule M-3 (Form 1065) if any of the following is true: The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.