Loading

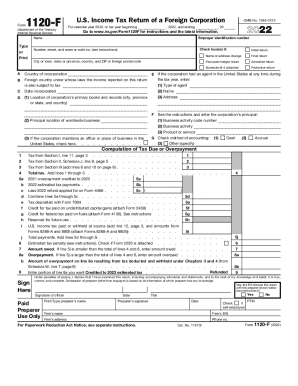

Get Irs 1120-f 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F online

This guide provides a clear and comprehensive overview of how to complete the IRS 1120-F form online. Designed for foreign corporations filing their U.S. income tax return, this resource will help users navigate each section with ease.

Follow the steps to successfully complete the IRS 1120-F online.

- Click ‘Get Form’ button to obtain the 1120-F form and open it in the online editor.

- Enter the employer identification number at the top of the form. This is crucial for identifying the corporation.

- Fill in the corporation's name, address, and country of incorporation. Ensure that all information is accurate to avoid processing delays.

- Indicate whether this is the corporation's initial return, amended return, or final return by checking the appropriate boxes.

- If applicable, enter the details of any agent for the corporation located in the U.S., including type, name, and address.

- Complete the sections regarding accounting methods; select cash, accrual, or another method of accounting.

- Fill out Section I to report income from U.S. sources not effectively connected with the conduct of a trade or business in the United States. Report gross amounts and applicable tax rates.

- In Section II, report income effectively connected with the U.S. trade or business, providing necessary deductions and exemptions.

- Complete the tax computation section in Schedule J, where you calculate the total tax liability.

- Finish by signing the form and including any required declarations, followed by reviewing all entries for completeness and accuracy.

- Once all sections are filled out, save changes, download, print, or share the form as necessary.

Complete your IRS 1120-F form online today for a seamless filing experience.

Related links form

The foreign corporation would file IRS form 1120-F to report their income, gains, losses, deductions, credits, and to figure their U.S. income tax liability similar to how a domestic corporation would report these on their tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.