Loading

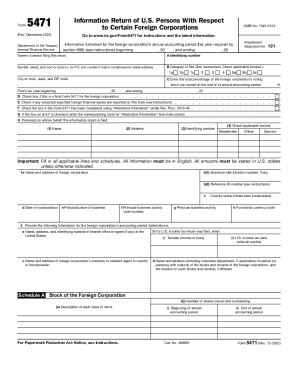

Get Irs 5471 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 online

The IRS 5471 form is essential for U.S. persons with interests in certain foreign corporations to report and comply with tax obligations. This guide provides clear, step-by-step instructions to assist users in filling out the form online effectively.

Follow the steps to complete the IRS 5471 form successfully.

- Click ‘Get Form’ button to obtain the form and access it for editing.

- Begin filling in your name as the person filing this return along with your identifying number. Make sure to provide your complete address, including city, state, and ZIP code.

- Indicate the category of filer by checking the appropriate box. Categories include various classifications for U.S. shareholders, officers, and directors.

- Enter the total percentage of the foreign corporation's voting stock you owned at the end of its accounting period. Record the applicable tax year beginning and ending dates.

- Complete the information regarding the foreign corporation, including its name, address, and identifying numbers. Fill out the date of incorporation and principal place of business.

- Provide necessary details for the foreign corporation’s accounting period, including any U.S. tax return filed and the name of the statutory or resident agent in the country of incorporation.

- Fill out Schedule A by detailing the stock classes of the foreign corporation, including the number of shares issued and outstanding.

- In Schedule B, include the information of U.S. shareholders along with the description of the stock held and the number held at the beginning and the end of the accounting period.

- Continue with Schedule C, entering the income statement data. Report all amounts in U.S. dollars derived from functional currency, adhering to U.S. GAAP.

- Complete Schedule F by providing a balance sheet that details the company's assets and liabilities. Report all figures in U.S. dollars.

- Finalize your form by thoroughly reviewing all entries for accuracy, saving any changes made during this process. Options may include downloading, printing, or sharing the completed form.

Take the next step to ensure compliance and complete your IRS 5471 form online now.

Whereas Form 5472 is for US companies that are owned by foreign persons, Form 5471 is for foreign companies owned by US persons. ... This means that if you own a Hong Kong corporation, a Panama corporation, a BVI corporation, or any other non-US corporation, it is reportable under Form 5471.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.