Loading

Get Ar Dfa Ar1000f 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000F online

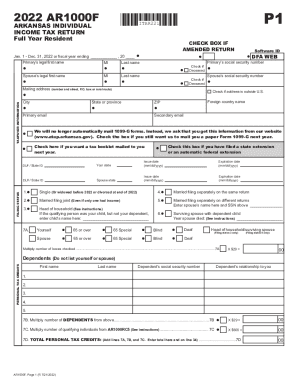

Completing the AR DFA AR1000F, the Arkansas individual income tax return for full-year residents, can seem daunting. However, this guide will provide clear, step-by-step instructions, helping you navigate each section with confidence as you fill out the form online.

Follow the steps to accurately complete your AR DFA AR1000F form.

- Click the ‘Get Form’ button to download the AR DFA AR1000F and open it in your chosen editing software.

- Begin by filling out your personal information in the taxpayer information section. Ensure that your name, mailing address, and social security number are accurately entered.

- Indicate your filing status by selecting the appropriate checkbox based on your situation—options include single, married filing jointly, and married filing separately.

- List any dependents you are claiming on the form. Ensure to include their names and social security numbers as required, but do not list yourself or your spouse.

- Proceed to the income section, where you will need to report all sources of income. Carefully fill in the amounts and follow any instructions regarding attachments that may be necessary.

- Complete the deductions section next, entering any applicable adjustments to your income as specified in the form instructions.

- Fill out the tax credits section, ensuring you calculate any personal tax credits you qualify for, based on the details of your dependents and any other qualifying factors.

- Once all sections are completed, review your entries for accuracy. Make any necessary corrections to ensure all information is correct.

- Finally, you can save your changes, then download, print, or share your completed form as needed. Ensure you keep a copy for your records.

Complete your AR DFA AR1000F online efficiently today!

AR2210 is the Arkansas Underpayment of Estimated Tax form. This form is added by TurboTax when it appears that you did not pay at least 90% of your Arkansas tax due and when the tax due is larger than $1,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.