Loading

Get Or Dor 41 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DoR 41 online

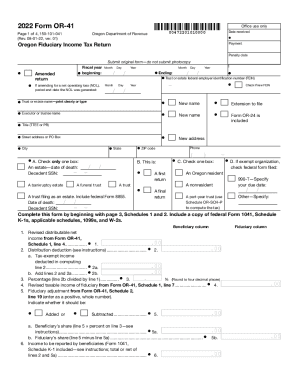

The OR DoR 41 form is essential for filing the Oregon Fiduciary Income Tax Return. This guide provides a clear and supportive step-by-step approach to help you complete the form online, ensuring you understand each component thoroughly.

Follow the steps to successfully fill out the OR DoR 41 form online.

- Press the ‘Get Form’ button to access the OR DoR 41 and open it in the online editor.

- Fill in the date received for office use only, located at the top of the form. This step is important for processing your submission.

- Provide the Trust or Estate Federal Employer Identification Number (FEIN). If it is a new FEIN, be sure to check the appropriate box.

- Clearly print or type the name of the trust or estate. If applicable, enter the new name, executor or trustee name, and the new address in the specified fields.

- In Section A, check the appropriate box to indicate what type of entity is filing the return, such as an estate or a trust, and provide the required date of death and decedent's social security number (SSN) if relevant.

- In Section B, denote whether this is a first return or a final return by checking the correct box, and provide information if it is an exempt organization.

- Complete the required calculations in the schedules provided. Begin with Page 3 for Schedules 1 and 2, and ensure you include all necessary documentation such as federal Form 1041 and Schedule K-1s.

- Fill out the calculations and make sure all numbers are accurate, as this will affect your tax calculation, tax credits, and any payments due or refunds owed.

- Review the completed form for any errors. Once verified, you can save the changes, download a copy, print it, or share it as needed.

Start completing your OR DoR 41 form online today for a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

What tax forms do I need to file my taxes? First and foremost, all individuals who must file income taxes will need to submit Form 1040. In fact, the full name for Form 1040 is the U.S. Individual Income Tax Return so when people talk about their tax returns, this is the form they're referring to.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.