Loading

Get Irs 1040 Schedule D Instructions 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule D Instructions online

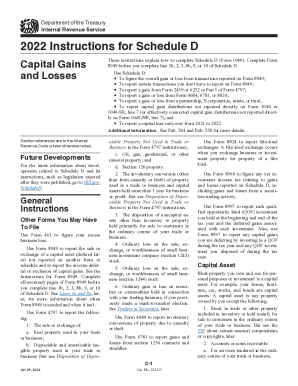

This guide provides clear and comprehensive instructions for completing the IRS 1040 Schedule D form. It includes specific steps on how to accurately report capital gains and losses, ensuring compliance and ease of filing.

Follow the steps to effectively complete the IRS 1040 Schedule D online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing the entire Schedule D form to understand its structure and components. Make sure to read through the instructions carefully to get a sense of your obligations. Remember to have Form 8949 completed before proceeding.

- Fill out Part I of Schedule D, where you report short-term capital gains and losses. List each transaction as follows: enter the description of the asset in column (a), the date acquired in column (b), the date sold in column (c), proceeds in column (d), cost or other basis in column (e), and gain or loss in column (h). Ensure all calculations are correct.

- Proceed to Part II for long-term capital gains and losses. Follow the same format as Part I: input descriptions in column (a), acquisition and sale dates in columns (b) and (c), proceeds in column (d), basis in column (e), and calculate gains or losses in column (h). Double-check your work.

- In line 13 of Schedule D, report any capital gain distributions you have received. This includes distributions from mutual funds or real estate investment trusts (REITs). Record the total amount from your Form 1099-DIV.

- Finally, review all the information provided in both parts for accuracy. Calculate your overall capital gains and losses, and ensure that everything is correctly filled out according to IRS guidelines.

- Once you have completed the form, save your changes, and then download or print the form for your records. You may also choose to share the completed document with your tax professional if needed.

Complete your IRS forms online today to ensure accurate and efficient filing!

The current capital gains tax rates under the new 2018 tax law are zero, 15 percent and 20 percent, depending on your income. The 2018 capital gains tax rate is holding steady through 2019, but the income required for each rate has changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.