Get Resale Certificate Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Resale Certificate NY online

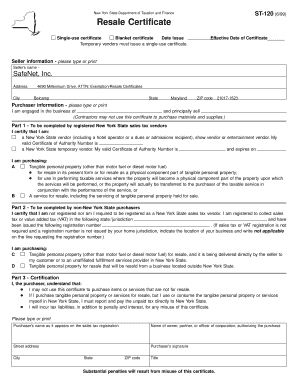

The Resale Certificate NY, also known as Form ST-120, is used for sales tax exemption when purchasing items for resale in New York State. This guide will provide clear and detailed steps to assist you in accurately completing the form online.

Follow the steps to fill out the Resale Certificate NY effectively.

- Click ‘Get Form’ button to acquire the form and access it in the editing interface.

- Begin by indicating whether the certificate is a single-use or blanket certificate by selecting the appropriate checkbox.

- Enter the issue date of the certificate in the designated field.

- For seller information, provide the seller's name, address, city, state, and ZIP code as required.

- In the purchaser information section, specify the nature of your business and what you principally sell.

- Complete Part 1 if you are a registered New York State sales tax vendor by confirming your status and providing your Certificate of Authority Number.

- If you are a non-New York State purchaser, complete Part 2 by certifying your registration status and including your registration number from your home jurisdiction, if applicable.

- In Part 3, certify your understanding of the usage limitations of the certificate by filling in your name, signature, business address, and title.

- Review all filled information for accuracy before finalizing.

- After completion, save changes, download, print, or share the form as necessary.

Complete your Resale Certificate NY online today for a smoother purchasing process.

To verify a New York resale certificate, you can contact the New York State Department of Taxation and Finance or visit their official website. They may provide an online database or further instructions on how to confirm the validity of the certificate. It's crucial to ensure that the resale certificate you receive is legitimate to avoid any issues with tax compliance. Resources from USLegalForms can also assist you in understanding the verification process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.