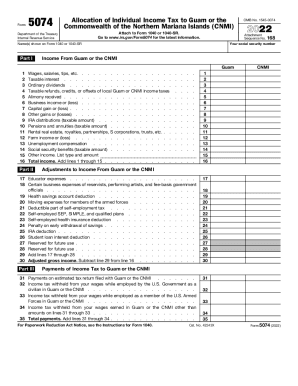

Get Irs 5074 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5074 online

How to fill out and sign IRS 5074 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren?t connected to document management and law procedures, submitting IRS forms can be quite tiring. We recognize the importance of correctly finalizing documents. Our online software proposes the solution to make the mechanism of processing IRS docs as easy as possible. Follow these tips to accurately and quickly complete IRS 5074.

The way to complete the IRS 5074 online:

-

Click the button Get Form to open it and start editing.

-

Fill all necessary lines in your doc utilizing our convenient PDF editor. Switch the Wizard Tool on to finish the procedure even simpler.

-

Make sure about the correctness of filled details.

-

Include the date of completing IRS 5074. Use the Sign Tool to create your personal signature for the document legalization.

-

Complete editing by clicking Done.

-

Send this file straight to the IRS in the most convenient way for you: via e-mail, using virtual fax or postal service.

-

It is possible to print it on paper if a hard copy is needed and download or save it to the favored cloud storage.

Utilizing our ultimate solution will make professional filling IRS 5074 a reality. We will make everything for your comfortable and quick work.

How to edit IRS 5074: customize forms online

Take advantage of the user friendliness of the multi-featured online editor while filling out your IRS 5074. Use the range of tools to quickly complete the blanks and provide the requested information right away.

Preparing documentation is time-consuming and pricey unless you have ready-to-use fillable forms and complete them electronically. The simplest way to deal with the IRS 5074 is to use our professional and multi-functional online editing solutions. We provide you with all the important tools for fast form fill-out and enable you to make any edits to your templates, adapting them to any demands. In addition to that, you can make comments on the changes and leave notes for other parties involved.

Here’s what you can do with your IRS 5074 in our editor:

- Complete the blanks using Text, Cross, Check, Initials, Date, and Sign options.

- Highlight significant information with a preferred color or underline them.

- Conceal confidential information using the Blackout option or simply erase them.

- Insert pictures to visualize your IRS 5074.

- Replace the original text using the one suiting your requirements.

- Add comments or sticky notes to inform others about the updates.

- Drop extra fillable fields and assign them to particular people.

- Protect the sample with watermarks, add dates, and bates numbers.

- Share the document in various ways and save it on your device or the cloud in different formats as soon as you finish modifying.

Working with IRS 5074 in our robust online editor is the fastest and most efficient way to manage, submit, and share your documentation the way you need it from anywhere. The tool works from the cloud so that you can access it from any place on any internet-connected device. All templates you create or prepare are securely stored in the cloud, so you can always open them whenever needed and be confident of not losing them. Stop wasting time on manual document completion and eliminate papers; make it all on the web with minimum effort.

Though, if you're simply wondering if you can staple a tax return, the answer is sort of. According to the article, you can staple your W-2 and 1099 to the front of your 1040 (in the appropriate income section.) But, be sure it doesn't staple through the rest of the documents!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.