Loading

Get Fayette Count Public Schools Net Profits Questionnaire Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fayette County Public Schools Net Profits Questionnaire Form online

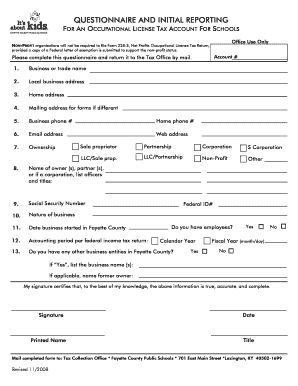

Completing the Fayette County Public Schools Net Profits Questionnaire Form is essential for complying with local tax regulations. This guide provides clear, step-by-step instructions to help you accurately fill out the form online.

Follow the steps to complete the questionnaire with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the business or trade name in the appropriate field. This identifies your organization’s primary name.

- Provide the local business address where your operations are headquartered.

- If your mailing address differs from the local business address, please specify it here.

- Fill out the business phone number and home phone number as required.

- Input your email address along with the website address if applicable. This facilitates communication.

- Select the type of ownership that best describes your business structure from the options provided.

- List the names of owners or partners, or if incorporated, include the titles of officers.

- Provide the Social Security Number in the designated area. This is necessary for identification.

- Describe the nature of your business, ensuring clarity about the services or products you provide.

- Enter the date your business started operating in Fayette County.

- Indicate the accounting period as specified in your federal income tax return.

- Answer whether you have any other business entities in Fayette County and list them if applicable.

- Indicate if you have employees working in Fayette County, and provide their details if applicable.

- Affirm the accuracy of your information by providing your signature, printed name, date, and title.

- After completing all sections, review the form for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your Fayette County Public Schools Net Profits Questionnaire Form online today to ensure compliance.

In Kentucky, both individuals and businesses that earn income within the state's borders are responsible for paying occupational taxes. This includes employees, freelancers, and business owners. If you are unsure about your tax obligations, utilizing the Fayette County Public Schools Net Profits Questionnaire Form can assist you in determining your liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.