Loading

Get Irs 8889 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8889 online

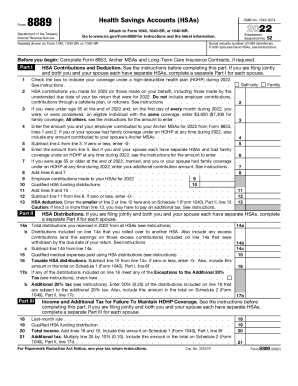

Filling out the IRS Form 8889 is essential for reporting contributions to and distributions from your Health Savings Account (HSA). This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently, catering to individuals with varying levels of experience.

Follow the steps to complete the IRS 8889 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and social security number as shown on your Form 1040, 1040-SR, or 1040-NR. If you are filing jointly and both you and your partner have HSAs, ensure you complete this for each individual.

- In Part I, check the box that indicates your coverage under a high-deductible health plan (HDHP) during the tax year. Make sure to read the accompanying instructions for any specifics.

- Enter the total HSA contributions you made for the tax year. This includes contributions made on your behalf by others before the due date of your tax return. Do not include contributions made by your employer or through a cafeteria plan.

- If you are under age 55 and were eligible for HSA contributions the entire year, enter the standard contribution limit for your coverage type. For self-only coverage, this is $3,650, and for family coverage, it is $7,300.

- If applicable, enter the contributions made to your Archer MSAs from Form 8853. Subtract this amount from your HSA contribution limit to determine your allowable deduction.

- Calculate your HSA deduction by entering the smaller figure from the previous lines as outlined. Ensure to read any cautionary notes about exceeding deductions, as they may incur additional taxes.

- Proceed to Part II to report HSA distributions. Enter the total distributions received from all HSAs. If any distributions were rolled over to another HSA or represent excess contributions withdrawn, input those amounts in the respective fields.

- Deduct qualified medical expenses from your total HSA distributions to ascertain the taxable portion. Report this figure as indicated.

- Lastly, ensure all information is accurate and complete. You can save your changes, download, print, or share the completed form as desired.

Complete your IRS documents online to ensure timely and accurate submissions.

Form 8889 is the IRS form that helps you to do the following: Report contributions to a Health Savings Account (HSA). Calculate your tax deduction from making HSA contributions. Report distributions you took from the HSA (hopefully for eligible medical expenses).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.