Loading

Get Irs 1040 - Schedule A 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule A online

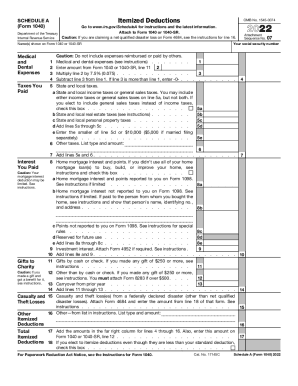

The IRS 1040 - Schedule A form is essential for reporting itemized deductions, which may reduce your taxable income. Completing this form online streamlines the process and is accessible for users of all experience levels.

Follow the steps to fill out the IRS 1040 - Schedule A online

- Click ‘Get Form’ button to access the IRS 1040 - Schedule A and open it in your preferred editor.

- Indicate medical and dental expenses in the corresponding section. Start by entering the total amount in the first field. Multiply the amount by 7.5% and enter this value in the next field. Subtract this value from your total, entering the result in the subsequent field, ensuring it’s not less than zero.

- Proceed to record gifts to charity. Complete lines for cash donations, specifying amounts over $250 as required. Attach Form 8283 for any gift exceeding $500.

- Fill in state and local taxes. Choose between income taxes or sales taxes, but not both. Sum your state and local real estate and personal property taxes to complete this section.

- Next, report home mortgage interest and points. If applicable, detail your mortgage interest amounts as instructed. If your mortgage was not fully utilized for your home, indicate this in the provided space.

- For casualties and theft losses, include any losses from federally declared disasters, utilizing Form 4684 as needed. Record these amounts accurately.

- Finally, sum all itemized deductions in the designated section. Verify the total and ensure it aligns with line 12 on Form 1040 or 1040-SR. You may elect to itemize deductions even if they are less than your standard deduction by marking the corresponding box.

- After completing the form, ensure to save your changes, and consider downloading, printing, or sharing the document as necessary.

Start filling out your IRS 1040 - Schedule A online to maximize your deductions efficiently.

Related links form

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are Mortgage Interest and certain Real Estate (property) taxes. These can be deducted in the year you buy your home if you itemize your deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.