Loading

Get Irs 990 - Schedule R 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule R online

Filling out the IRS 990 - Schedule R is essential for organizations that engage with related entities. This guide provides a clear and straightforward approach to help you navigate the form successfully, ensuring compliance with the IRS requirements.

Follow the steps to complete the IRS 990 - Schedule R online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the employer identification number (EIN) and the name of the organization in the designated fields at the top of the form.

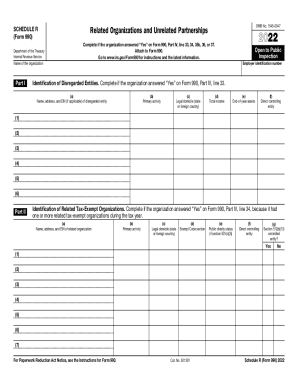

- Complete Part I for the identification of disregarded entities if applicable by providing the name, address, and EIN of the disregarded entity, along with its primary activity, legal domicile, total income, end-of-year assets, and direct controlling entity.

- In Part II, provide details for any related tax-exempt organizations. You will need their name, address, EIN, primary activity, legal domicile, exempt code section, public charity status, and whether they had a section 512(b)(13) controlled entity.

- Fill out Part III for any related organizations taxable as partnerships, entering information about each entity's name, address, EIN, primary activity, legal domicile, direct controlling entity, nature of income, share of total income, and any relevant allocations.

- For Part IV, complete details for related organizations that are taxable as corporations or trusts. Provide similar information as in the previous parts, focusing on the type of entity and relevant financial data.

- In Part V, you will need to disclose any transactions with related organizations. List the types of transactions and indicate their amounts as required.

- Proceed to Part VI to report information regarding unrelated organizations taxable as partnerships if applicable, including detailed information about each entity's operations.

- Finally, use Part VII for any supplemental information that clarifies previous sections.

- Once all sections are complete, review the information for accuracy, then save changes to the form. You can choose to download, print, or share the completed document.

Complete your IRS 990 - Schedule R online today to ensure compliance and accurate reporting.

Publicly available data on electronically filed Forms 990 is available in a machine-readable format through Amazon Web Services (AWS). The data includes Form 990, Form 990-EZ and Form 990-PF and related schedules, with the exception of certain donor information, from 2012 to the present.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.