Loading

Get Sc Dor Sch.tc-57a 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SCH.TC-57A online

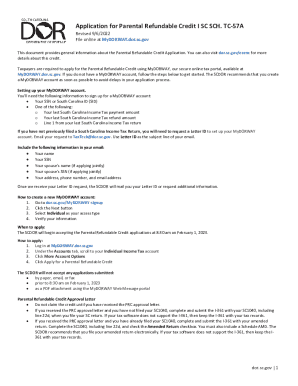

This guide provides users with a clear and comprehensive approach to completing the SC DoR SCH.TC-57A form online. Whether you're a first-time applicant or familiar with the process, these step-by-step instructions will help you navigate the form efficiently.

Follow the steps to successfully submit your application for the parental refundable credit.

- Press the ‘Get Form’ button to acquire the SC DoR SCH.TC-57A form and open it in your digital editor.

- Provide your full legal name and Social Security Number (SSN) as the initiating parent. If applicable, include your spouse's name and SSN.

- Fill in your contact information, including address, phone number, and email. Make sure this information matches your MyDORWAY account.

- Indicate your household's income range and provide estimates for additional expenses related to caring for exceptional needs children.

- Enter the number of children living in your household and specify how many of them are exceptional needs children. Remember that each number must be greater than zero.

- Provide qualifying student information, which includes the full legal name, SSN, age, sex, and grade level of each exceptional needs child.

- List the names of the schools attended and the corresponding attendance dates for each qualifying student.

- Document tuition costs, which should include the total tuition for the 2022 calendar year, any reductions (credits, discounts, scholarships), and the out-of-pocket tuition costs.

- Input any grants received from Exceptional SC during the 2022 calendar year and total tuition payments made in that year.

- Once all information is complete, submit the application. You will need to enter your MyDORWAY password to serve as your electronic signature.

- After submission, you can save any changes, download, print, or share your completed form for your records.

Start filling out your SC DoR SCH.TC-57A application online today!

If you are required to use your personal vehicle for work, can you claim gas on taxes or do you just use the standard mileage deduction? Yes, you can claim gas on taxes as a deductible business expense. However, you must keep adequate records that show the following: Cost of expense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.