Loading

Get Mn Dor C58p 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR C58P online

Filling out the MN Department of Revenue's C58P form is an essential step in assessing your financial situation. By providing this information, you enable the department to evaluate your ability to pay, ensuring the process is efficient and accurate.

Follow the steps to complete the MN DoR C58P form online.

- Click the ‘Get Form’ button to access the form and open it for editing.

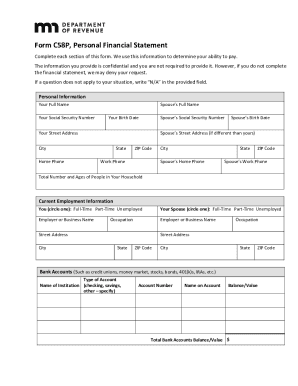

- Begin with the personal information section. Enter your full name and Social Security Number. If you have a spouse, include their full name and Social Security Number as well. Complete your birth date and your spouse’s if applicable, along with your street address, city, state, and ZIP code. Make sure to include contact numbers.

- In the current employment information section, indicate your employment status by circling the appropriate option: full-time, part-time, or unemployed. Do the same for your spouse if applicable. Document the names and addresses of your employers, including your occupations.

- Proceed to the bank accounts section. List each type of account you hold, the financial institution's name, account number, account holder's name, and the balance or value of each account. Summarize the total balance or value of all bank accounts.

- Fill out the virtual currency section by listing any types of cryptocurrency you possess along with their respective names, email addresses used for accounts, and valuation in US dollars. Summarize the total value of your virtual currency.

- Next, detail your living expenses. Provide amounts for taxes withheld, rent or mortgage, child support, insurance, utilities, groceries, and other monthly expenses to calculate your total monthly living expenses.

- Continue to the real estate section where you provide information about your properties, including addresses, county, mortgage balances, current values, and minimum monthly payments.

- Fill in the credit card section with card names, credit limits, current balances, and minimum monthly payments to determine total credit card payments.

- List any motor vehicles you own, detailing their year, make, model, current balance owed, and minimum monthly payments.

- Describe any other obligations you have, including home equity loans or personal loans, by providing the type, current balance, and payment details.

- Calculate the combined total of your monthly expenses, including totals from the previous sections.

- Document your income details, including gross monthly pay from all adults contributing to household expenses. Attach two recent pay stubs for each individual.

- If necessary, provide any additional information in the designated section, attaching extra papers if needed.

- Complete the authorization section, confirming the accuracy of the information provided. Finally, sign and date your submission before printing, saving, or sharing the completed form.

Take the next step by completing the MN DoR C58P form online to streamline your financial assessment.

If you are a full-year Minnesota resident, you must file a Minnesota income tax return if your income meets the state's minimum filing requirement. ... If you are a part-year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.