Loading

Get Ne Substitute W-9 & Ach Enrollment 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Substitute W-9 & ACH Enrollment online

Filling out the NE Substitute W-9 & ACH Enrollment form online is essential for streamlined payment processing and tax compliance. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the NE Substitute W-9 & ACH Enrollment online.

- Press the ‘Get Form’ button to obtain the NE Substitute W-9 & ACH Enrollment form and open it for editing.

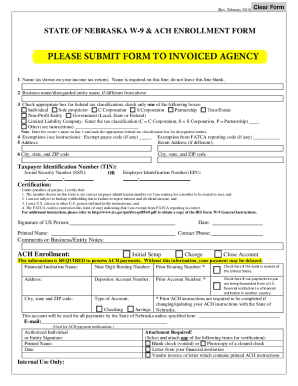

- In the first section, enter your name exactly as it appears on your income tax return. Ensure this field is filled in; it cannot be left blank.

- If applicable, enter your business name or disregarded entity name in the second field, only if it differs from your legal name.

- In this section, check the appropriate box that corresponds to your federal tax classification. Ensure to select only one option from the following choices: individual, sole proprietor, corporation, partnership, trust/estate, non-profit entity, government, limited liability company, or other.

- Fill in the exemption section if applicable. Include any exempt payee code, if you have one, and provide the exemption from FATCA reporting code, if relevant.

- Provide your primary address details, including city, state, and ZIP code. If your remit address differs, fill in those details in the designated section.

- Enter your Taxpayer Identification Number (TIN). You can provide either your Social Security Number (SSN) or your Employer Identification Number (EIN). Ensure this field is properly filled out.

- Review the certification section carefully. Ensure you understand and agree to all declarations regarding your taxpayer identification number and FATCA status.

- Sign and date the form in the designated areas, and print your name and contact phone number.

- For the ACH Enrollment section, specify whether this is for initial setup, changing, or closing your account. Provide the required banking information including financial institution name, routing number, and account number.

- If applicable, check the boxes related to the financial institution location and ensure the account type is indicated as checking or savings.

- Complete the signature section for the authorized individual or entity, including their printed name and date.

- Ensure to attach the required documents for verification, which may include a voided check, a cleared check, or a letter from your financial institution.

- Once all fields are completed, you can save changes, download, print, or share the filled-out form.

Complete your NE Substitute W-9 & ACH Enrollment form online today to ensure prompt payment processing.

Related links form

Some companies require you to submit an updated W-9 form, Request for Taxpayer Identification Number and Certification, each year, but most do not. Independent contractors face the possibility of filing a W-9 form annually to keep the contract's records current, but it is not always necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.