Loading

Get Ca Ftb 100s 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100S online

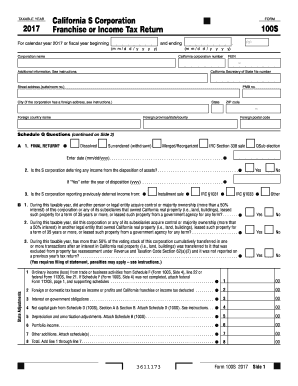

This guide provides a clear and supportive overview of how to complete the CA FTB 100S, which is the California S Corporation Franchise or Income Tax Return. Following these steps will help ensure that your form is accurately filled out and submitted online.

Follow the steps to successfully complete your CA FTB 100S form online.

- Press the ‘Get Form’ button to access and open the document in the editor.

- In the top section of the form, enter the corporation name, California corporation number, and Federal Employer Identification Number (FEIN). Ensure that all information is current and accurate.

- Fill in the corporation's address, including street, city, state, and ZIP code. If the corporation has a foreign address, refer to specific instructions regarding foreign details.

- Address the Schedule Q questions that appear on the form, indicating whether this is a final return and if the S corporation has undergone any changes during the taxable year.

- Continue through the income and adjustments sections, providing necessary computations based on your corporation's earnings and deductions.

- Complete the deductions section, adding relevant sub-schedules as needed, and ensuring you capture all applicable deductions.

- Review the detailed steps regarding credits, tax payments, and withholdings as reported on the form. Ensure all calculations are correctly performed.

- Once you have completed all sections of the form, verify that all entries are accurate and consistent. Consider reviewing your entries for clarity.

- Finalize the form by saving your changes, or proceed to download, print, or share the completed form according to your filing requirements.

Take the next step and complete your CA FTB 100S form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 100 FTB is the California corporation franchise or income tax return. This form is specifically for C corporations conducting business in California. It captures important financial information, allowing the state to assess tax liabilities appropriately. For assistance with your filing, consider using resources from US Legal Forms, which offer easy-to-follow guides for various tax forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.