Loading

Get In Wh-1 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN WH-1 online

This guide provides a comprehensive overview of how to accurately complete the IN WH-1 form online, ensuring users can easily navigate each section. It offers step-by-step instructions tailored for individuals with varying levels of legal experience.

Follow the steps to fill out the IN WH-1 form efficiently.

- Click the ‘Get Form’ button to access the IN WH-1 form and open it in your chosen editor.

- Begin filling out the total amount of Indiana State Tax withheld in the appropriate field.

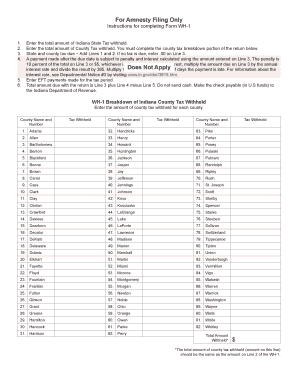

- Next, enter the total amount of County Tax withheld. Ensure to complete the county tax breakdown section, detailing tax withheld for each county on the form.

- Calculate the state and county tax due by adding the amounts from Lines 1 and 2. If no tax is due, enter .00 on Line 3.

- Be aware that late payments are subject to penalty and interest, which is based on the amount entered on Line 3. The penalty is 10 percent of the total on Line 3 or $5, whichever is greater.

- If applicable, enter all Electronic Funds Transfer (EFT) payments made for the tax period in the designated section.

- Calculate the total amount due with the return, which is Line 3 plus Line 4 minus Line 5. Note that cash should not be sent; checks must be made payable to the Indiana Department of Revenue.

- Complete the county tax breakdown by entering the withheld amounts for each county where applicable.

- Finally, review your entries, save changes, and either download, print, or share the completed IN WH-1 form as needed.

Start completing your IN WH-1 form online today for a smooth filing experience.

Related links form

Forms beginning with the number 1 typically include various tax-related forms at both the state and federal levels. Depending on the specific form, the filing method and address may vary. It is best to refer to the detailed instructions available on the IN WH-1 platform to ensure proper filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.