Loading

Get Mt Dor Mw-3 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR MW-3 online

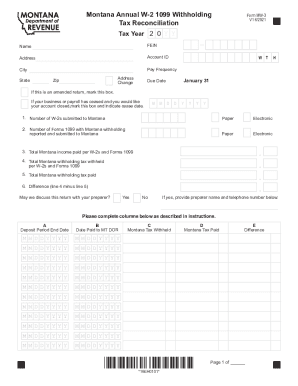

Filling out the Montana Department of Revenue MW-3 form online can streamline your tax reconciliation process significantly. This guide provides clear, step-by-step instructions to help you complete the form accurately, ensuring compliance with Montana tax regulations.

Follow the steps to fill out the MT DoR MW-3 form online.

- Click ‘Get Form’ button to access the MW-3 form and open it in the online editor.

- Enter the tax year for which you are filing in the designated box at the top of the form.

- Provide your name, Federal Employer Identification Number (FEIN), address, and account ID in the relevant fields.

- Indicate your pay frequency in the 'Pay Frequency' section.

- Complete line 1 by entering the total number of W-2s submitted, making sure to mark whether they are reported on paper or electronically.

- Proceed to line 2 and enter the number of Forms 1099 with Montana withholding available, also specifying the filing method.

- On line 3, indicate the total Montana income paid as reported on your W-2s and Forms 1099.

- Fill in line 4 with the total Montana withholding tax withheld per W-2s and Forms 1099.

- In line 5, enter the total Montana withholding tax you have paid to the Department of Revenue.

- Calculate the difference between line 4 and line 5 for line 6. If the resulting difference is negative, include a minus sign.

- Complete the columns for the deposit period end date, date paid, Montana tax withheld, Montana tax paid, and any differences as instructed.

- If applicable, mark the box for amended returns or account closures, and indicate the relevant dates.

- Review all entries for accuracy, then save your changes. You can download, print, or share the completed form as necessary.

Complete your Montana tax documents online today to ensure timely and accurate filing.

Form 1042-S is used to report amounts paid to foreign persons that are subject to income tax withholding, even if no amount is deducted and withheld from the payment because of a treaty or exception to taxation, or if any amount withheld was repaid to the payee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.