Loading

Get Or Form Or-tm 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form OR-TM online

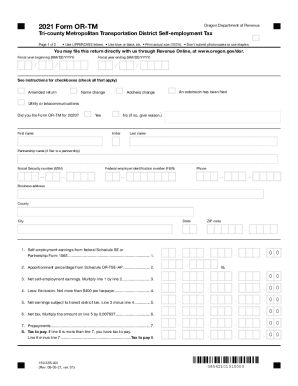

Filling out the OR Form OR-TM online is a crucial step for individuals and partnerships reporting self-employment earnings in Oregon. This guide provides step-by-step instructions to ensure that you accurately complete the form with ease.

Follow the steps to successfully fill out the OR Form OR-TM.

- Click ‘Get Form’ button to obtain the OR Form OR-TM and open it in your online editor.

- Enter the fiscal year beginning and ending dates in the provided format (MM/DD/YYYY).

- Check all applicable boxes regarding return status, such as amended return or name change.

- Indicate if you filed Form OR-TM for 2020 by selecting 'Yes' or 'No'. If 'No', provide a reason.

- Complete personal information fields, including first name, initial, last name, and, if applicable, partnership name.

- Provide your Social Security number (SSN) or Federal employer identification number (FEIN), and include your contact phone number.

- Fill in the business address details including county, city, state, and ZIP code.

- Report self-employment earnings from federal Schedule SE or Partnership Form 1065 in the designated field.

- Input apportionment percentage from Schedule OR-TSE-AP as required.

- Calculate net self-employment earnings by multiplying the amounts from the previous fields as instructed.

- Deduct the exclusion amount (not more than $400 per taxpayer) from your net earnings.

- Determine the net earnings subject to transit district tax by subtracting the exclusion from the previous line.

- Calculate the net tax by multiplying the amount subject to tax by 0.007837.

- Record any prepayments made previously in the designated field.

- Calculate the tax to pay by subtracting any prepayments from the net tax owed.

- Include any penalty and interest for late filing or payment as necessary.

- Total the amount due by adding the tax to pay and any penalties.

- If applicable, calculate any refund due by subtracting the net tax owed from any overpayments.

- Provide a brief description of business activity and include the required copies of supporting schedules.

- Sign and date the form, including any preparer's information if applicable.

- Once all fields are completed, remember to save changes, and download, print, or share the form as needed.

Complete your OR Form OR-TM online today to ensure your self-employment tax responsibilities are met accurately.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Salem headquarters Phone: (503) 378-4988 or (800) 356-4222. Phones are closed 9 to 11 a.m.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.