Get Irs 2210 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 2210 online

How to fill out and sign IRS 2210 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Legal, business, tax as well as other e-documents need a top level of compliance with the law and protection. Our templates are updated on a regular basis according to the latest legislative changes. Plus, with our service, all of the information you include in the IRS 2210 is well-protected from leakage or damage by means of cutting-edge file encryption.

The following tips will help you fill in IRS 2210 quickly and easily:

- Open the template in our feature-rich online editing tool by clicking on Get form.

- Complete the necessary boxes which are yellow-colored.

- Hit the arrow with the inscription Next to move from field to field.

- Go to the e-autograph solution to add an electronic signature to the form.

- Add the relevant date.

- Double-check the whole template to ensure that you have not skipped anything important.

- Click Done and save your new form.

Our service allows you to take the whole process of completing legal documents online. Due to this, you save hours (if not days or even weeks) and get rid of unnecessary expenses. From now on, fill in IRS 2210 from the comfort of your home, business office, or even while on the move.

How to edit IRS 2210: customize forms online

Sign and share IRS 2210 together with any other business and personal paperwork online without wasting time and resources on printing and postal delivery. Take the most out of our online document editor using a built-in compliant electronic signature tool.

Approving and submitting IRS 2210 documents electronically is faster and more efficient than managing them on paper. However, it requires making use of online solutions that guarantee a high level of data security and provide you with a compliant tool for creating eSignatures. Our powerful online editor is just the one you need to complete your IRS 2210 and other individual and business or tax templates in an accurate and suitable way in line with all the requirements. It features all the essential tools to easily and quickly complete, modify, and sign documentation online and add Signature fields for other people, specifying who and where should sign.

It takes just a few simple steps to fill out and sign IRS 2210 online:

- Open the chosen file for further processing.

- Use the top toolkit to add Text, Initials, Image, Check, and Cross marks to your sample.

- Underline the important details and blackout or remove the sensitive ones if needed.

- Click on the Sign tool above and choose how you prefer to eSign your sample.

- Draw your signature, type it, upload its image, or use an alternative option that suits you.

- Switch to the Edit Fillable Fileds panel and drop Signature areas for other people.

- Click on Add Signer and provide your recipient’s email to assign this field to them.

- Verify that all information provided is complete and correct before you click Done.

- Share your form with others using one of the available options.

When approving IRS 2210 with our extensive online editor, you can always be sure to get it legally binding and court-admissible. Prepare and submit paperwork in the most beneficial way possible!

Related links form

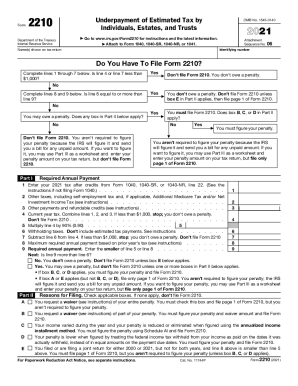

Internal Revenue Service (IRS) Form 2210 is used to calculate the penalty liability for individuals, estates, and trusts that have failed to make timely payments of income taxes throughout the tax year. ... Form 2210-F calculates the same penalty liability, but is specifically used by farmers and fishermen.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.