Loading

Get 2010 Form 2106

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 2106 online

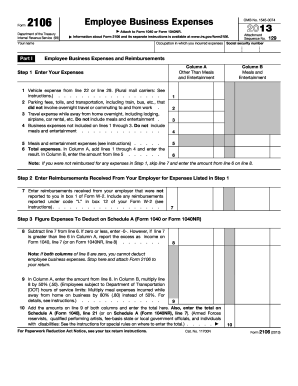

Filling out the 2010 Form 2106 can seem daunting, but with clear guidance, you can complete it efficiently. This form is used to report employee business expenses, which can potentially reduce your taxable income.

Follow the steps to complete Form 2106 online.

- Click ‘Get Form’ button to obtain the form and open it in an editor.

- Enter your personal information including your name and social security number at the top of the form.

- In Part I, start by entering your occupation in which you incurred the expenses in the designated field.

- For Step 1, provide detailed entries for your expenses. This includes vehicle expenses, parking fees, travel costs while away from home, and other business expenses. Make sure not to include meals in this section.

- Continue with Step 2 to record any reimbursements received from your employer for the expenses listed in Step 1. Ensure to include only amounts not reported in box 1 of your W-2.

- In Step 3, calculate the amount of expenses to deduct on Schedule A by subtracting the amount in line 7 from the total in line 6.

- Complete Part II by providing information about vehicle expenses, including the date the vehicle was placed in service, total miles driven, and business miles. Fill out the remaining sections based on your vehicle usage.

- Once all sections are completed, review your entries for accuracy. You can then proceed to save your changes, download, print, or share the completed Form 2106.

Complete your 2010 Form 2106 online to ensure you accurately report your business expenses.

Tax form 2106 is used to calculate and report business expenses that employees incurred while performing job duties. Traditionally, this form has helped employees claim valuable deductions. With the changes brought by the Tax Cuts and Jobs Act, many taxpayers may need alternative forms for expense reporting. Utilizing services like uslegalforms can help you navigate these tax processes effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.