Loading

Get Tx Comptroller 50-144 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

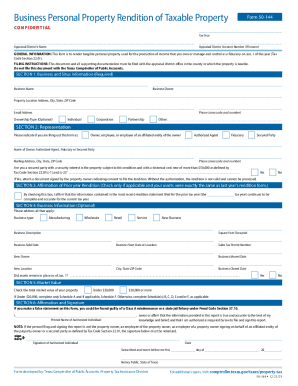

This guide provides users with a clear and supportive framework for completing the TX Comptroller 50-144 form online. Whether you are new to this process or need a refresher, following these steps will ensure proper completion of the Business Personal Property Rendition form.

Follow the steps to accurately fill out the TX Comptroller 50-144 online.

- Press the ‘Get Form’ button to access the TX Comptroller 50-144 form and open it in an editor.

- Enter the tax year in the specified field. This is typically the year for which you are rendering the property.

- Complete the appraisal district’s name and, if known, include the appraisal district account number.

- In Section 1, provide your business name, owner’s name, the property location, and your email address. Optionally select your ownership type.

- Proceed to Section 2 to indicate your representation type. Select if you are an owner, an authorized agent, fiduciary, or secured party.

- In Section 3, if applicable, check the box to affirm that your prior year's rendition remains accurate.

- Fill out Section 4 with optional business information, including type and description.

- In Section 5, select your total market value option of the property. If under $20,000, complete only Schedule A; if $20,000 or more, proceed to the appropriate schedules.

- Complete Schedules A through F as necessary, providing detailed descriptions and estimates for your personal property.

- Review the information in Section 6, sign, and date the form. If applicable, ensure the signature is notarized.

- Once completed, you can save your changes, download the form, print it, or share it as needed.

Complete your TX Comptroller 50-144 form online today to ensure your business personal property is properly rendered.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Seniors who fill out Form 1040SR must take the standard deduction. Remember that if you're 65 or over, you are entitled to an additional $1,300. For an individual, that would raise the standard deduction to $13,300 for the tax year 2019, the first year that you can use the form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.