Loading

Get Irs Instruction 943 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 943 online

Filling out the IRS Instruction 943 can seem daunting, but this guide offers a clear, step-by-step approach to ensure you complete the form accurately. This document serves as your roadmap for navigating through each section and field successfully.

Follow the steps to complete your IRS Instruction 943 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN), name, and address in the designated spaces. Ensure the name reflects your business as registered with the IRS.

- Fill out the number of agricultural employees you had during the pay period that included March 12, 2021. Do not include household employees.

- Report all cash wages paid to farm employees subject to federal income tax, social security tax, and Medicare tax on the appropriate lines.

- Include any qualified sick leave wages and family leave wages separately as instructed, ensuring correct reporting according to recent federal guidelines.

- Calculate your total taxes owed by adding all relevant tax amounts on the form, including social security and Medicare taxes.

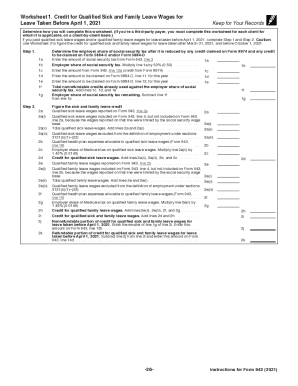

- Complete the section for any credits you are claiming, such as for qualified sick leave wages and family leave wages, using Worksheets 1, 2, 3, 4, and 5 as necessary.

- Before submitting, review all entries for accuracy. Save your changes, and then you can download, print, or share the form as needed.

Complete your IRS Instruction 943 form online today for accurate and timely submission.

Related links form

About Form 944, Employer's Annual Federal Tax Return Form 944 is designed so the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.