Loading

Get Irs 1040 - Schedule E 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule E online

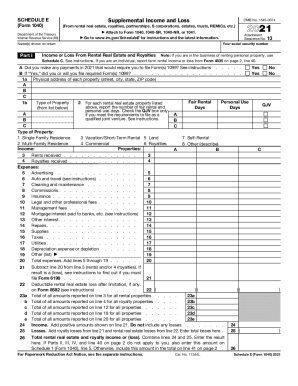

Filling out the IRS 1040 - Schedule E online can be a streamlined process for reportingsupplemental income and loss from various sources such as rental real estate and partnerships. This guide provides a step-by-step approach to help users understand and complete the form efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the IRS 1040 - Schedule E and open it in your preferred online editing tool.

- Begin by entering your name and social security number in the designated fields at the top of the form.

- In Part I, indicate whether you made payments that require filing Form 1099 by selecting 'Yes' or 'No'. If 'Yes', specify if you have filed the required forms.

- For each rental property, enter the physical address, and select the type of property from the list provided.

- Report the number of fair rental and personal use days for each property. Check the QJV box if applicable.

- Report your income by entering rents received and royalties received in the corresponding fields.

- List and total your expenses, such as advertising, auto and travel, cleaning, and other costs in their respective fields.

- Calculate the total expenses by adding all listed expenses and enter the result.

- Subtract the total expenses from your reported income to determine your net income or loss.

- Continue filling out relevant sections for partnerships, S corporations, or other sources of income, ensuring accurate reporting on nonpassive and passive income.

- Finish by summing up all sources of income or loss as indicated and transferring the relevant figures to your main Form 1040.

- Once all sections are complete, save your changes, and download or print the completed form for your records.

Start filling out your IRS 1040 - Schedule E online today to ensure timely and accurate tax reporting.

If you rent real estate such as buildings, rooms or apartments, you normally report your rental income and expenses on Form 1040, Schedule E, Part I. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E. See the Instructions for Form 4562 to figure the amount ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.