Loading

Get St 1 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 1 Form online

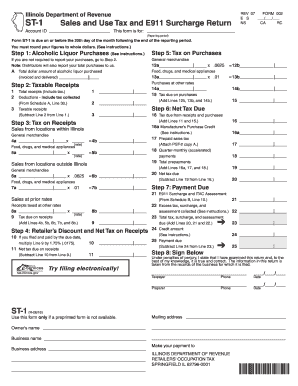

The St 1 Form is an essential document for reporting sales and use tax along with the E911 surcharge to the Illinois Department of Revenue. This guide will provide clear, step-by-step instructions on how to fill out the form online, ensuring accuracy and compliance.

Follow the steps to complete the St 1 Form efficiently.

- Click ‘Get Form’ button to begin the process of obtaining the St 1 Form electronically.

- In Step 1, report the total dollar amount of alcoholic liquor purchased. Ensure this amount is accurate and reflects invoiced and delivered liquor.

- Proceed to Step 3 to calculate the tax on receipts from Illinois sales, specifying the rates applicable for general merchandise and medical supplies.

- In Step 7, determine the E911 surcharge by following the provided guidelines for calculating tax on receipts from various locations.

- Finally, review all entered information for accuracy. Users can then save changes, download, print, or share the completed form.

Complete your St 1 Form online now to ensure compliance and avoid penalties.

In Maine, the service provider tax is imposed on specific services offered to consumers and businesses. This tax is essential for funding public services and infrastructure. Service providers are required to collect, report, and remit this tax, often using the proper forms, like the St 1 Form, to ensure compliance. Knowing your responsibilities regarding this tax is crucial to avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.