Loading

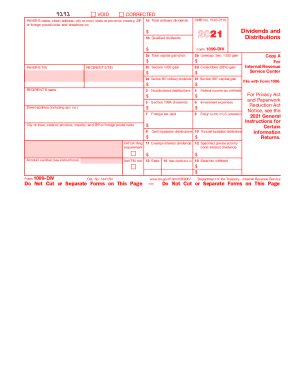

Get Irs 1099-div 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

Completing the IRS 1099-DIV form online is essential for reporting dividends and distributions. This guide provides clear and detailed steps to assist users in navigating the online form effectively, ensuring compliance and accuracy.

Follow the steps to fill out the IRS 1099-DIV online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the payer’s name, address, and contact information in the designated fields. This information identifies the individual or entity distributing the dividends.

- Provide the taxpayer identification number (TIN) for both the payer and the recipient. Ensure that these numbers are accurate to avoid potential penalties.

- Input the total ordinary dividends in Box 1a. This amount represents the total dividends received that are subject to taxation.

- Record the portion of ordinary dividends that qualify for reduced tax rates in Box 1b.

- Continue filling in the relevant sections regarding capital gain distributions and potential additional gains as applicable, using Boxes 2a through 2f.

- Complete any applicable fields regarding foreign tax paid, investment expenses, and other distributions in Boxes 6 through 11.

- Provide any necessary state identification numbers and tax withheld information in Boxes 13 through 15.

- Review all entered information for accuracy, ensuring all fields are correctly filled.

- After completing the form, you can save changes, download, print, or share the 1099-DIV as needed.

Ensure your IRS 1099-DIV is filled out correctly by following these steps online.

The dividend tax rate you will pay on ordinary dividends is 22%. Qualified dividends, on the other hand, are taxed at the capital gains rates, which are lower. For the 2018 tax year, you will not need to pay any taxes on qualified dividends as long as you have $38,600 or less of ordinary income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.