Loading

Get Irs Eitc 11652 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Eitc 11652 online

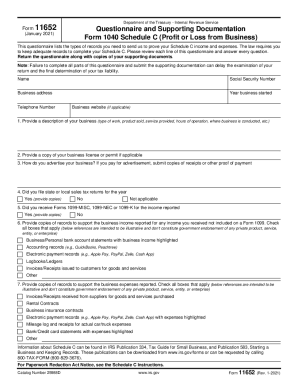

The IRS Eitc 11652 is a crucial form for users documenting their business income and expenses related to Schedule C. This guide will provide clear, step-by-step instructions to help you navigate the online process of filling out this form accurately.

Follow the steps to complete the IRS Eitc 11652 questionnaire online.

- Press the ‘Get Form’ button to access the document and open it in your chosen digital editor.

- Begin filling out your personal information, including your name, Social Security number, business address, and contact details.

- Indicate the year your business was established to provide context regarding your operations.

- Describe your business comprehensively, detailing the type of work, products, services, hours of operation, and locations.

- If applicable, make sure to upload a copy of your business license or permit as required.

- Outline your advertising strategies and upload any receipts or proof of payments for your advertisements.

- Answer the question regarding state or local sales tax returns for the year, providing evidence if applicable.

- Respond to whether you received Forms 1099-MISC, 1099-NEC, or 1099-K, attaching copies if you did.

- Compile and upload records that support your reported business income, checking the relevant boxes for different types of documents.

- Compile and upload records that support your reported business expenses, following similar steps as previous.

- Review your completed form for accuracy and ensure all mandatory fields are filled.

- Save your changes, then opt to download, print, or share the completed form as necessary.

Start completing your IRS Eitc 11652 questionnaire online today to ensure compliance and accuracy.

Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit. You'll figure your self-employment tax on Schedule SE.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.