Get Irs W-8ben-e 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8BEN-E online

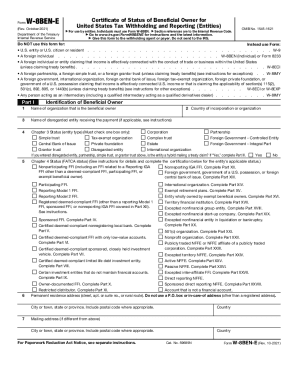

The IRS W-8BEN-E form is essential for entities that are foreign to the United States, allowing them to claim benefits or exemptions under U.S. tax law. This guide provides clear, step-by-step instructions to help users navigate and accurately complete the form online.

Follow the steps to successfully complete the W-8BEN-E form online.

- Click ‘Get Form’ button to obtain the W-8BEN-E form and open it for editing.

- In Part I, enter the name of the organization that is the beneficial owner in the appropriate field.

- If applicable, provide the name of any disregarded entity receiving the payment.

- Select the entity type by checking the corresponding box under Chapter 3 Status.

- Provide the country of incorporation or organization in the designated field.

- Fill out the permanent residence address, ensuring to exclude P.O. boxes.

- If required, include the U.S. taxpayer identification number (TIN) and any foreign TIN as applicable.

- Complete Part II if a disregarded entity is involved, providing relevant details.

- In Part III, check the certifications related to tax treaty benefits, if applicable.

- Review and complete any additional parts that apply based on your entity’s classification, following the prompts for each section.

- Verify all information for accuracy before submitting.

- Finally, save your changes, and download, print, or share the completed form as necessary.

Start completing your W-8BEN-E form online now for efficient tax compliance.

Essentially, it serves an opposite function to the W-8BEN-E. Whereas the W-8BEN-E form exempts a foreign entity from the 30% tax rate based on a country's treaty status, the W-8BEN form documents a business as owing the full 30% rate, and ensures that the tax is filed as payable.

Fill IRS W-8BEN-E

Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). I certify that the entity identified in Part I: • Is a controlled foreign corporation as defined in section 957(a);. • Is not a QI, WP, or WT;. An IRS Form W-8BEN form is a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting purposes. These instructions supplement the instructions for Forms W8 BEN, W8 BENE, W8 ECI, W8 EXP, and W8 IMY. Individuals must use Fonn W-SBEN. ▻ Section references are to the Internal Revenue Code. It's an important document that enables a business operating outside of the US to claim tax exemption on US-sourced income. It's an important document that enables a business operating outside of the US to claim tax exemption on US-sourced income. Individuals should not use Form W-8BEN-E.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.