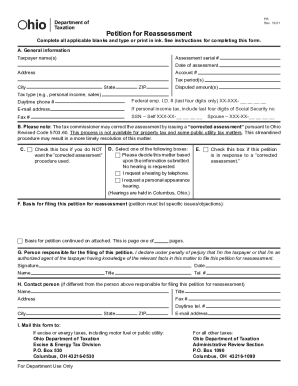

Get Oh Odt Pr 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH ODT PR online

How to fill out and sign OH ODT PR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Today, most Americans prefer to do their own taxes and, moreover, to fill out forms electronically. The US Legal Forms web-based service helps make the process of e-filing the OH ODT PR fast and convenient. Now it will require not more than thirty minutes, and you can accomplish it from any place.

How you can get OH ODT PR quick and easy:

-

Open up the PDF sample in the editor.

-

Refer to the outlined fillable fields. Here you can place your data.

-

Click on the option to select when you see the checkboxes.

-

Proceed to the Text tool and also other sophisticated functions to manually customize the OH ODT PR.

-

Inspect every piece of information before you resume signing.

-

Create your unique eSignature using a key-board, digital camera, touchpad, mouse or mobile phone.

-

Certify your PDF form electronically and specify the particular date.

-

Click Done continue.

-

Save or deliver the document to the recipient.

Ensure that you have filled in and sent the OH ODT PR correctly in due time. Look at any applicable term. If you provide wrong info in your fiscal papers, it can result in severe fines and create problems with your yearly income tax return. Use only expert templates with US Legal Forms!

How to edit OH ODT PR: customize forms online

Fill out and sign your OH ODT PR quickly and error-free. Find and edit, and sign customizable form templates in a comfort of a single tab.

Your document workflow can be far more efficient if all you need for editing and managing the flow is arranged in one place. If you are looking for a OH ODT PR form sample, this is a place to get it and fill it out without searching for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Simply type the name of the OH ODT PR or any other form and find the right template. If the sample seems relevant, you can start editing it right on the spot by clicking Get form. No need to print or even download it. Hover and click on the interactive fillable fields to place your details and sign the form in a single editor.

Use more editing tools to customize your template:

- Check interactive checkboxes in forms by clicking on them. Check other parts of the OH ODT PR form text by using the Cross, Check, and Circle tools

- If you need to insert more text into the document, use the Text tool or add fillable fields with the respective button. You can even specify the content of each fillable field.

- Add images to forms with the Image button. Upload images from your device or capture them with your computer camera.

- Add custom graphic elements to the document. Use Draw, Line, and Arrow tools to draw on the form.

- Draw over the text in the document if you want to hide it or stress it. Cover text fragments with theErase and Highlight, or Blackout instrument.

- Add custom elements such as Initials or Date with the respective tools. They will be generated automatically.

- Save the form on your computer or convert its format to the one you want.

When equipped with a smart forms catalog and a powerful document editing solution, working with documentation is easier. Find the form look for, fill it out immediately, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution tailored for editing forms.

Related links form

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years. The IRS tries to audit tax returns as soon as possible after they are filed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.