Loading

Get Sc Dor Sc1040 Instructions 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 Instructions online

Filing your South Carolina Individual Income Tax Return SC1040 can seem daunting, but with the right guidance, it can be straightforward. This guide will walk you through the essential steps to fill out the SC DoR SC1040 Instructions online, ensuring you understand each section and field required.

Follow the steps to successfully complete your SC1040 online.

- Click the ‘Get Form’ button to access the SC1040 form. This will allow you to open it in the editor where you can fill it out.

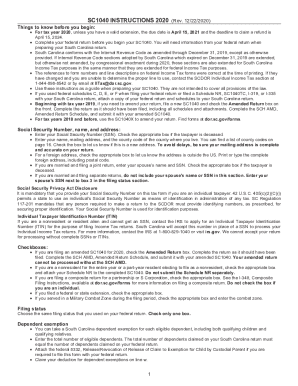

- Begin by entering your Social Security Number (SSN) in the designated field. If applicable, check the box indicating if the taxpayer is deceased.

- Input your full name, mailing address, and the county code associated with your residence. Check the box for a new address if applicable.

- If filing a joint return, enter your spouse's name and SSN in the appropriate fields. For separate returns, omit this information.

- Review the checkboxes for various filing situations, such as amended returns or if you are a nonresident. Mark the boxes that apply to you.

- Select the appropriate filing status consistent with your federal return. Ensure only one box is checked.

- Complete the dependent exemption section by entering the total number of eligible dependents claimed on your federal return.

- Proceed with filling in the income data as required, starting from your federal taxable income. Make sure to follow the provided guidance for additions and subtractions.

- After completing the income and deductions sections, calculate your South Carolina tax using the SC1040 tax tables or rates.

- Finally, review all entered information for accuracy. Save your changes, and choose whether to download, print, or share the completed form for submission.

Start filling out your SC DoR SC1040 Instructions online today for a smooth tax filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

South Carolina is very tax-friendly toward retirees When it comes to where you're going to retire, taxes are an important part of the equation. South Carolina's tax code is great for retirees; not only is Social Security not taxable, but there's a sizable deduction for other kinds of retirement income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.