Loading

Get Va Va-8453 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VA-8453 online

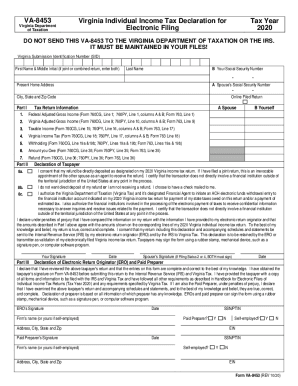

The Virginia Individual Income Tax Declaration for Electronic Filing, known as VA VA-8453, is an essential document for taxpayers filing electronically. This guide offers a comprehensive overview of how to complete the form online, ensuring your submission is accurate and compliant.

Follow the steps to successfully complete the VA VA-8453 online.

- Press the ‘Get Form’ button to download the VA VA-8453 form, and access it in your preferred editor.

- Enter the Virginia Submission Identification Number (SID) at the top of the form. This identifier is crucial for tracking your submission.

- Fill in your first name and middle initial (if applicable) as well as your last name. If filing a joint return, include your partner's information as well.

- Provide the Social Security Number for both yourself and your partner, ensuring the numbers are accurate and correctly formatted.

- Complete the present home address, including city, state, and zip code, as this will be used for correspondence.

- In Part I, indicate if your return was filed online, and provide your Federal Adjusted Gross Income from the relevant forms (e.g., Form 760CG, Line 1).

- Continue to fill out the rest of the tax return information, including Virginia Adjusted Gross Income, Taxable Income, and any withholding amounts based on the provided forms.

- In Part II, select your preference for direct deposit of your refund or indicate that you prefer a check to be mailed.

- If you opt for electronic payment, authorize the Virginia Department of Taxation to initiate the necessary transactions by completing the relevant fields.

- Review all provided information for accuracy, confirming that it matches the numbers reported on your tax return.

- In Part III, sign and date the form, ensuring that both you and your partner sign if applicable.

- Lastly, save your completed form, and choose to download, print, or share the document as needed for your records.

Now that you're equipped with this guide, proceed to compete your VA VA-8453 online and ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. The form can be used for current or future tax years. Additionally, custodial parents can use tax Form 8332 to revoke the release of this same right.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.