Loading

Get Nj Dot C-9600 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT C-9600 online

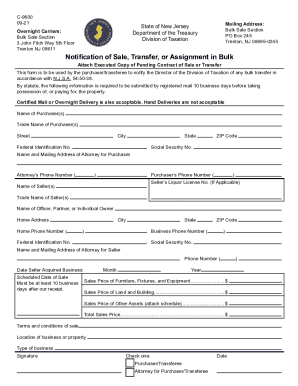

Filling out the NJ DoT C-9600 form is an essential step for purchasers involved in the sale, transfer, or assignment of business assets. This guide will provide you with clear and concise instructions to successfully complete the form online.

Follow the steps to accurately complete the NJ DoT C-9600 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the purchaser(s) and the trade name, if applicable. Include the street address, city, state, federal identification number, and ZIP code. Enter the social security number as required.

- Next, provide the name and mailing address of the attorney for the purchaser, including their phone number.

- Enter the seller’s liquor license number, if applicable, along with the name of the seller(s) and their trade name.

- Complete the information for the individual owner, which includes their name, home address, home phone number, city, state, ZIP code, business phone number, and social security number.

- Include the name and mailing address of the attorney for the seller, along with their phone number.

- Specify the date the seller acquired the business and the scheduled date of sale, ensuring it is at least 10 business days after the division's receipt of this form.

- Detail the sales price for furniture, fixtures, equipment, land, buildings, and any other assets, summing these to give a total sales price.

- Outline the terms and conditions of the sale, the location of the business or property, and the type of business involved.

- Sign the form, indicating whether you are the purchaser/transferee or the attorney for the purchaser/transferee and include the date of signing.

- Once completed, save your changes and prepare to submit the form. Remember, submissions must be sent via overnight, certified, or registered mail.

- Finally, you can download, print, or share the form as needed for your records.

Complete your NJ DoT C-9600 form online today and ensure a smooth transaction process!

To order by phone, call 800-908-9946 and follow the prompts. You can also request your transcript using your smartphone with the IRS2Go mobile phone app. Businesses that need a tax account transcript should use Form 4506-T, Request for Transcript of Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.