Loading

Get Il 700 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL 700 online

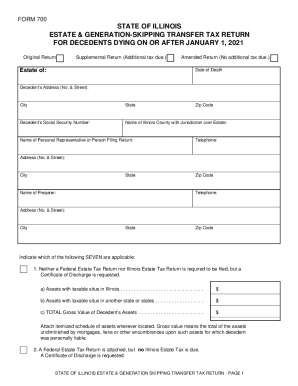

The IL 700 is the Estate & Generation-Skipping Transfer Tax Return for decedents dying on or after January 1, 2021. This guide provides a step-by-step approach to efficiently complete the form online, ensuring all necessary information is accurately recorded.

Follow the steps to fill out the IL 700 online.

- Press the 'Get Form' button to obtain the IL 700 form and open it in your preferred online editor.

- Begin by entering the decedent's information, including their name, address, and social security number. Ensure accuracy to avoid complications in processing.

- Indicate the applicable type of return by checking the appropriate box for Original, Supplemental, or Amended Return as required.

- Complete the section detailing the assets of the decedent's estate. Provide a total gross value, ensuring this includes all assets without deducting for mortgages or liens.

- If applicable, indicate whether a Federal Estate Tax Return is attached, and specify if an Illinois QTIP election is being made, along with related amounts.

- Fill out the Recapitulation section, which summarizes tax amounts, any penalties, and interest. Be sure this total reflects all findings from previous sections.

- Review each section for completeness and accuracy. Once verified, proceed to save your changes, download a copy for your records, or print the form for submission.

Complete your IL 700 online today to ensure timely filing and compliance with state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Generally, the rate for withholding Illinois Income Tax is 4.95 percent. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by 4.95 percent.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.