Loading

Get Tx Comptroller Ap-114 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller AP-114 online

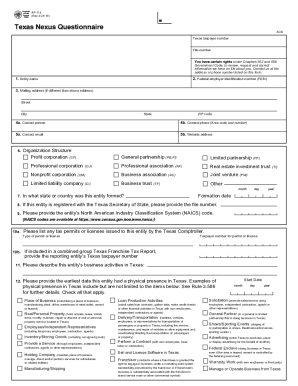

The TX Comptroller AP-114 is a crucial document for entities conducting business in Texas, serving as a nexus questionnaire. This guide provides clear, step-by-step instructions for efficiently completing this form online, ensuring all relevant information is accurately submitted.

Follow the steps to complete the TX Comptroller AP-114 online.

- Press the ‘Get Form’ button to access the TX Comptroller AP-114 and open it in your preferred editor.

- Enter the entity name in the designated field. Ensure the name matches the official registered name.

- Provide the federal employer identification number (FEIN) in the corresponding box.

- If your mailing address differs from the entity's address, input the street address, city, state, and ZIP code in the relevant fields.

- Input the contact person's name, followed by their phone number in the area code and number format.

- Provide the contact email address and website address for your entity.

- Select the organization structure from the list provided, marking the appropriate type of entity.

- Specify the state or country where the entity was formed.

- If applicable, provide the file number registered with the Texas Secretary of State.

- Input the date of formation by selecting the corresponding month, day, and year.

- Enter the NAICS code for your entity, as required. Reference the related link for accurate classification.

- List any tax permits or licenses issued to the entity by the Texas Comptroller, including corresponding taxpayer numbers.

- Describe the business activities conducted by the entity in Texas.

- Provide the earliest date the entity had a physical presence in Texas, checking all relevant options that apply.

- Answer whether the entity will exceed $500,000 in gross receipts from Texas business and provide the start date if applicable.

- Complete the section for general and limited partners with 10% or more interest, including their names, addresses, and ownership percentages.

- Review the declaration statement and ensure all information is true to the best of your knowledge before signing.

- Finally, save your changes, then download or print the form, or choose to share it as necessary.

Complete your TX Comptroller AP-114 online to ensure compliance and streamline your application process.

Related links form

A franchise tax is a government levy (tax) charged by some US states to certain business organizations such as corporations and partnerships with a nexus in the state. A franchise tax is not based on income. Rather, the typical franchise tax calculation is based on the net worth of or capital held by the entity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.