Loading

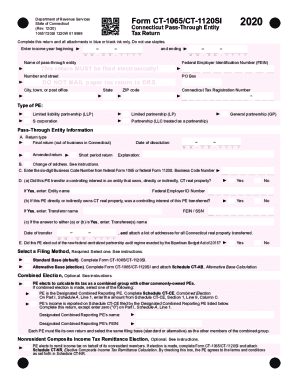

Get Ct Drs Ct-1065/ct-1120si 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-1065/CT-1120SI online

This guide provides comprehensive instructions on how to complete the CT DRS CT-1065/CT-1120SI form online. Designed for various users, this resource will help you navigate each section of the form with ease.

Follow the steps to fill out your tax return accurately.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Enter the income year for which you are filing the return, specifying both the beginning and ending dates.

- Provide the name of the pass-through entity and its Federal Employer Identification Number (FEIN).

- Indicate the type of pass-through entity, selecting from options such as limited liability partnership (LLP), limited partnership (LP), or S corporation.

- In the Pass-through entity information section, specify whether this is a final return, amended return, or a change of address.

- Complete Part I, Schedule A, by entering the amount of income or loss subject to tax.

- Proceed to Part I, Schedule B, to compute the pass-through entity's own Connecticut source income/loss, following the table provided.

- Continue filling out the modifications section in Part I, Schedule C, adjusting for any necessary Connecticut modifications.

- If applicable, complete Part II for allocation and apportionment of income.

- Provide details in Part III for member information, including names, addresses, and ownership percentages.

- Review all filled sections for accuracy; then save your changes.

- Finally, download, print, or share the completed form as needed.

Now that you have your guide, fill out your CT DRS CT-1065/CT-1120SI form online with confidence.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Motor Vehicle Property Tax. Motor vehicles are subject to a local property tax under Connecticut state law, whether registered or not. Motor vehicles are assessed according to State statutes at 70% of the Clean Retail value through the use of the NADA Guides and other resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.