Loading

Get Ut Tc-69c 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-69C online

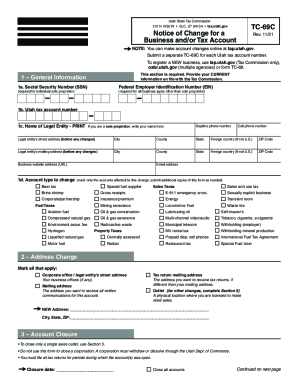

Filling out the UT TC-69C form is crucial for reporting changes to your business and tax accounts in Utah. This guide will assist you through each section of the form, ensuring that you complete it correctly and efficiently.

Follow the steps to complete the UT TC-69C form online.

- Click 'Get Form' button to access the UT TC-69C form online and open it in the editor.

- In Section 1, provide your General Information. Include your Social Security Number (SSN) or Federal Employer Identification Number (EIN), if applicable, as well as your Utah tax account number. Fill out the required name of the legal entity and the business's street and mailing addresses.

- Indicate the type of account changes you are requesting by checking the relevant box in Section 1d. Select all applicable tax types that are affected by this change.

- If you need to report any address changes, move to Section 2. Mark the appropriate checkboxes for types of addresses you are changing and fill in the new address details.

- For account closure, proceed to Section 3. Enter the closure date and check the option to close all accounts or close a single sales outlet by completing the required fields.

- Use Section 4 to report any other account changes such as phone numbers or email addresses. Provide the new information as needed.

- In Section 5, report changes specific to existing sales outlets. Indicate whether you are closing an outlet or changing its details, and provide the relevant information.

- Finally, complete Section 6 by signing and dating the form. An authorized signature is required for the form to be processed.

Complete your documents online for a smooth and hassle-free experience.

Related links form

The state of Utah has a single personal income tax, with a flat rate of 4.95%. According to the Tax Foundation, total state income tax collections in Utah average $981 per person. This is the 25th highest in the country. Sales taxes in Utah range from 5.95% to 8.60%, depending on local rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.