Loading

Get In Dor It-20x 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR IT-20X online

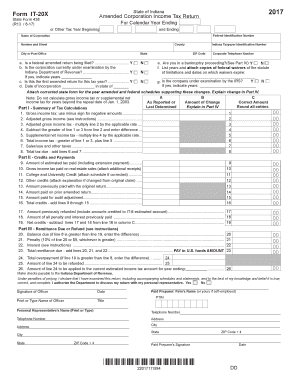

Filling out the IN DoR IT-20X form online is an essential step for corporations looking to amend a previously filed Indiana Corporation Income Tax Return. This guide provides clear and practical instructions to help users complete the process with confidence.

Follow the steps to successfully complete your IN DoR IT-20X form online.

- Press the ‘Get Form’ button to access the IT-20X form and open it for editing.

- Enter your federal identification number in the designated box at the upper-right corner of the form.

- Input your Indiana taxpayer identification number in the provided field.

- Fill in the corporation's name, address, county, city, state, ZIP code, and telephone number accurately.

- Respond to the questions regarding your federal amended return, bankruptcy proceedings, and other relevant inquiries by selecting 'Yes' or 'No' as applicable.

- Provide the date of incorporation and state of incorporation in the specified fields.

- Complete Part I by summarizing your tax calculations, ensuring to include all relevant amounts as instructed in the associated sections.

- Continue to Part II and accurately report any credits and payments made, ensuring to attach any required documentation.

- In Part III, calculate the remittance due or refund based on the provided guidelines, entering all amounts in the appropriate fields.

- In Part IV, provide a clear explanation of the changes and attach all necessary supporting documentation and schedules.

- Sign and date the form, ensuring that your name and title are printed clearly.

- Save your changes, then download, print, or share the completed form as needed.

Complete your IN DoR IT-20X form online today for a seamless amendment process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Indiana allows taxpayers to file amended returns electronically, making the process more convenient. Use the IN DoR IT-20X e-filing option to expedite your amendments and ensure quicker processing. This can save time and reduce the hassle associated with paper filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.