Loading

Get In Dor Db020w-nr 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR DB020W-NR online

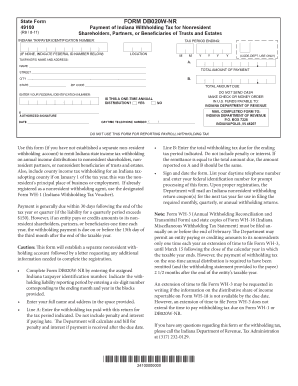

Filling out the IN DoR DB020W-NR form online can streamline the process of remitting Indiana state income tax withholding for nonresident shareholders, partners, or beneficiaries. This guide provides detailed, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the IN DoR DB020W-NR form online

- Click the ‘Get Form’ button to access the form and open it for editing.

- Enter your Indiana taxpayer identification number in the designated field.

- Indicate the tax period ending by entering a six-digit number that represents the month and year in the provided blocks.

- Fill in your full name and address in the specified area, ensuring all details are accurate.

- Line A: Input the total amount of withholding tax paid for the indicated tax period. Do not include penalties or interest for late payment.

- Line B: Enter the total withholding tax due for the ending tax period. Ensure that this amount reflects only the withholding tax and matches Line A if applicable.

- Sign and date the form at the bottom to validate your submission.

- Provide your daytime telephone number and federal identification number to assist with the processing of the form.

- Once all information is completed, save your changes. You can then download, print, or share the form as necessary.

Start completing your IN DoR DB020W-NR form online today!

Related links form

Non-resident tax in the US pertains to taxes imposed on individuals or entities earning income in a state where they do not reside. This tax ensures that non-residents contribute to the infrastructure and services of the state in which they generate income. Each state, including Indiana, has specific regulations regarding non-resident taxation, which are detailed in the IN DoR DB020W-NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.