Loading

Get Ca Form 3521 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3521 online

Filing the CA Form 3521 online can be a straightforward process if you follow the right steps. This comprehensive guide will walk you through each section of the form to ensure you provide accurate information and complete your filing successfully.

Follow the steps to complete your CA Form 3521 online.

- Click ‘Get Form’ button to access the CA Form 3521 and open it for editing.

- Begin by entering your name(s) as they appear on your California tax return in the appropriate field. Make sure to select the correct identification option: SSN or ITIN, California Corporation number, or FEIN.

- Provide the Building Identification Number (BIN). If you have multiple buildings, attach a separate list of all BINs that pertain to this credit.

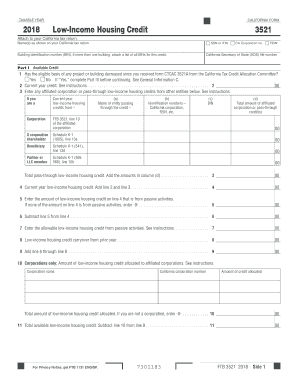

- In Part I, Available Credit, answer the initial question regarding any decrease in the eligible basis of any project or building since the receipt of form CTCAC 3521A. Select ‘Yes’ or ‘No’ accordingly.

- For current year credit, enter the applicable amount in the designated field. Follow the detailed instructions provided in the form.

- List any affiliated corporation or pass-through low-income housing credits from other entities in the appropriate sections. Utilize the specific lines to enter details such as names and identification numbers.

- Add the amounts as indicated in the provided columns to arrive at your total pass-through low-income housing credit.

- Proceed to calculate the current year low-income housing credit by adding lines 2 and 3 together.

- If applicable, subtract any amounts from passive activities as indicated on the form to finalize your available low-income housing credit.

- In Part II, enter the credit claimed for the current year tax return and any credit assigned from other forms, if necessary. Use the calculations provided to arrive at your carryover for future years.

- If your project's basis has decreased, complete Part III with relevant information for each building as specified.

- Finally, review your entries for accuracy, then save your changes as a digital file, and you can download, print, or share the completed form as needed.

Start your online filing for the CA Form 3521 today to ensure you don't miss any deadlines.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Obtaining California tax forms is straightforward. You can access forms online through the California Franchise Tax Board's website or request them by mail. For customized forms, including the CA Form 3521, consider visiting UsLegalForms, where you can find a variety of legal documents tailored to your needs. Make sure to review your forms thoroughly to ensure accuracy before submission.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.