Get Il Dor Ptax-203-a 1999-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR PTAX-203-A online

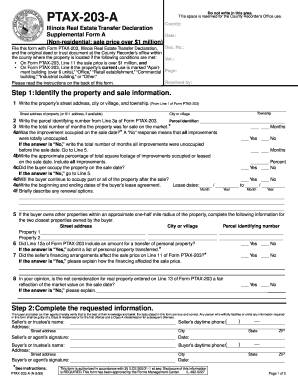

The IL DoR PTAX-203-A form is a crucial document for the declaration of real estate transfers in Illinois, particularly for non-residential properties sold for over $1 million. This comprehensive guide will walk you through the online process of accurately completing this form, ensuring you meet all necessary requirements and deadlines.

Follow the steps to fill out the IL DoR PTAX-203-A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary fields for completing the document accurately.

- Identify the property and sale information by filling out the address, city or village, township, and parcel identifying number. Include the total number of months the property was on the market.

- Indicate whether the improvement was occupied on the sale date. If not occupied, provide the total months unoccupied before the sale.

- Complete the details regarding occupancy by the buyer and any lease agreement they have concerning the property.

- If relevant, provide information regarding any other properties owned by the buyer close to the sold property.

- Answer questions regarding whether personal property was transferred with the sale and if financing arrangements affected the sale price.

- Evaluate and indicate if the net consideration for real property reflects a fair market value on the date of sale.

- Complete the seller's and buyer's information including names, addresses, and phone numbers, followed by signatures to verify the accuracy of the provided information.

- Upon completing the form, you can save changes, download, print, or share the document as needed.

Start filling out your IL DoR PTAX-203-A form online today!

Related links form

The term 'PTAX' refers to property tax forms used in Illinois, which help in documenting transactions involving real estate. It is usually associated with various forms, like the IL DoR PTAX-203-A, that facilitate the assessment and collection of transfer taxes. Understanding PTAX can simplify real estate transactions and ensure compliance with state regulations.

Fill IL DoR PTAX-203-A

Consulte cotações de fechamento de uma moeda em um período e acesse boletins intermediários de taxas de câmbio. Conheça a taxa para compra e a taxa para venda do dólar dos Estados Unidos da América no fechamento diário. Tenha acesso à cotação de todas as moedas, à cotação de fechamento do dólar dos Estados Unidos e aos boletins intermediários de câmbio em uma data. Acompanhe o desempenho dos principais indicadores dos mercados de derivativos financeiros e agropecuários da B3. Taxas de câmbio referenciais B3. Tabelas de conversão de moeda estrangeira para reais — Imposto sobre a renda da pessoa jurídica (IRPJ). 1. Retorna a Cotação de Compra e a Cotação de Venda da moeda Dólar contra a unidade monetária corrente para o período informado. Consulte as taxas de compra e de venda e paridades de compra e de venda de todas as moedas, conforme o fechamento da PTAX do Banco Central do Brasil, na data. Dólar turismo (venda) Cotações diárias do segmento de câmbio de taxas flutuantes, disponíveis para o período de 27.5. The purpose of the PTAX-203 form is to document real estate transactions in Illinois for tax enforcement purposes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.