Get Il Dor Cpp-1 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR CPP-1 online

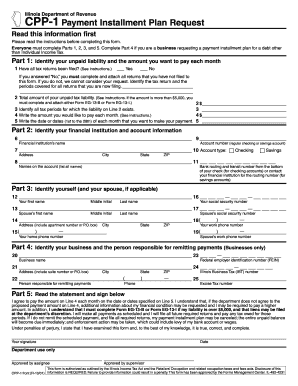

The Illinois Department of Revenue's CPP-1 form is essential for individuals and businesses seeking a payment installment plan for their unpaid tax liabilities. This guide will walk you through the process of completing the CPP-1 online, ensuring that you have all necessary information ready for submission.

Follow the steps to complete the CPP-1 form efficiently.

- Click ‘Get Form’ button to access the CPP-1 form and open it in the editor.

- In Part 1, begin by identifying your unpaid tax liability. Ensure all tax returns are filed by marking 'Yes' or 'No'. If 'No', attach the necessary returns. Indicate the total amount of unpaid tax liability and the specific tax periods for which this liability exists. Specify the monthly payment amount and the preferred payment date within the month.

- In Part 2, provide your financial institution's details. Enter the name, address, and account number of your bank, and specify the type of account (checking or savings). List all names associated with the account.

- Proceed to Part 3, where you will enter your personal information. Fill in your first name, middle initial, last name, and social security number. If applicable, provide the same information for your spouse.

- For Part 4, if you are a business, complete the business section. Input the business name, address, and federal employer identification number (FEIN). Provide the name of the person responsible for making payments.

- Finally, in Part 5, read the statement carefully and sign to confirm your agreement with the payment terms. Include the date of your signature.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed for your records.

Take the next step and complete your IL DoR CPP-1 form online today.

Get form

Related links form

To make a payment to the Illinois Department of Revenue, you can use MyTax Illinois for a convenient online payment option. Once logged in, you will find various payment methods available, such as electronic funds transfer and credit or debit card payments. It is advisable to have your tax account number ready to ensure your payment is processed accurately. For an organized approach to managing your payments, consider exploring the IL DoR CPP-1 resources available through US Legal Forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.