Loading

Get Id St-101 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID ST-101 online

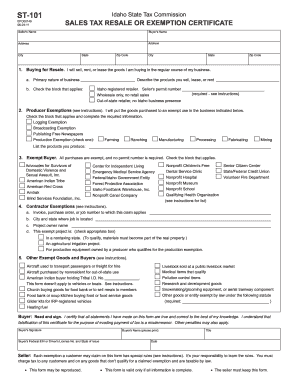

The ID ST-101 is the sales tax resale or exemption certificate used in Idaho. This guide will help you complete the form online by providing clear, step-by-step instructions for each section of the form to ensure accuracy and compliance.

Follow the steps to successfully fill out the ID ST-101 online.

- Click ‘Get Form’ button to access the ID ST-101 and open it in the editor.

- In the first section, input the seller's name, buyer's name, their addresses, city, state, and zip code as required.

- For 'Buying for Resale', indicate if you are selling, renting, or leasing goods in the regular course of business. Provide a brief description of the primary nature of business and the products sold. Ensure that the Idaho seller's permit number is included if applicable.

- In the 'Producer Exemptions' section, select the applicable exemption type and complete any required fields, detailing the products produced.

- If applicable, choose the exempt buyer option and list any pertinent organizations or entities, fulfilling any additional requirements as indicated in the instructions.

- For 'Contractor Exemptions', provide the invoice, purchase order, or job number related to the claim, along with the location and project owner name.

- Use the 'Other Exempt Goods and Buyers' section to list any exemptions not already covered on the form. Be specific about the exemption law referenced.

- After completing the form, ensure all fields are filled out accurately. Once satisfied with the entries, you can save your changes, download, print, or share the form as needed.

Start filling out the ID ST-101 online to ensure compliance and efficiency in your transactions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Exemptions in Idaho apply to various situations, including income, age, and property type. Specific criteria, such as being a senior citizen or a disabled individual, typically qualify applicants. Furthermore, you can find exemption details within the ID ST-101 form, which provides a clear outline of what qualifies in your case.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.