Loading

Get Ca Cdtfa-735 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CDTFA-735 online

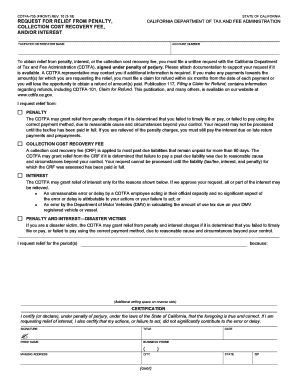

The CA CDTFA-735 form allows users to request relief from penalties, collection cost recovery fees, and interest associated with California tax obligations. This guide provides step-by-step instructions to fill out the form online, ensuring a smooth and efficient process.

Follow the steps to complete the CA CDTFA-735 online.

- Click the ‘Get Form’ button to access the CA CDTFA-735 and open it in your document editor.

- Fill in your taxpayer or feepayer name in the designated field. This should be the name of the individual or business requesting the relief.

- Enter your account number accurately. This number is essential for the CDTFA to process your request correctly.

- Select the type of relief you are requesting by checking the appropriate boxes: penalty relief, collection cost recovery fee relief, or interest relief.

- If you are requesting relief for any penalty, explain the reasonable cause for the delay, ensuring to provide any information that shows circumstances beyond your control.

- For interest relief requests, provide reasons why the CDTFA should grant this relief, such as errors by a CDTFA employee or the DMV.

- If applicable, indicate if you are a disaster victim requesting relief due to circumstances related to a disaster.

- In the certification section, declare that the provided information is true under penalty of perjury, ensuring accuracy and honesty in your submission.

- Sign the form and include your printed name, title, and business phone number to confirm your identity and contact information.

- Provide your mailing address, including city, state, and ZIP code, ensuring that it matches your official records.

- Once all sections are filled, review your information for accuracy before saving your changes.

- Finally, download, print, or share the completed form as necessary based on your preference for submission.

Complete your CA CDTFA-735 form online today for efficient processing of your relief request.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A sales tax audit can be triggered by several factors, including a mismatch between reported sales and income, failure to remit collected sales taxes, or an unexpected spike in business transactions. The CA CDTFA-735 pays attention to these discrepancies to ensure compliance. Regular audits help maintain transparency in tax practices.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.