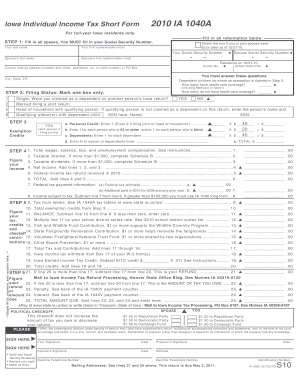

Get Ia Dor 1040a 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IA DoR 1040A online

How to fill out and sign IA DoR 1040A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your income and submitting all the necessary tax forms, including IA DoR 1040A, is the exclusive responsibility of a US citizen.

US Legal Forms makes managing your taxes much more user-friendly and precise.

Keep your IA DoR 1040A secure. Ensure that all your relevant documents and information are organized while being aware of the deadlines and tax rules established by the IRS. Make it easy with US Legal Forms!

- Access IA DoR 1040A on your web browser from any device.

- Click to open the fillable PDF file.

- Begin filling out the template box by box, utilizing the guidance of the advanced PDF editor's interface.

- Carefully enter text and numbers.

- Click the Date box to automatically set the current date or adjust it manually.

- Use the Signature Wizard to create your unique e-signature and sign in just minutes.

- Consult the IRS guidelines if you have further inquiries.

- Select Done to preserve the modifications.

- Proceed to print the document, save, or send it through Email, SMS, Fax, or USPS without leaving your browser.

How to Modify Get IA DoR 1040A 2010: Tailor Forms Online

Experience a hassle-free and paperless method of modifying Get IA DoR 1040A 2010. Utilize our reliable online service and save a significant amount of time.

Creating each document, including Get IA DoR 1040A 2010, from the ground up demands excessive effort, which is why employing a reliable solution of pre-made document templates can significantly enhance your efficiency.

However, altering them can be challenging, particularly with documents in PDF format. Thankfully, our extensive library includes a built-in editor that enables you to swiftly complete and modify Get IA DoR 1040A 2010 without the need to leave our website, preventing the loss of hours on your paperwork. Here’s how to manage your file using our tools:

Whether you need to finalize editable Get IA DoR 1040A 2010 or any other document found in our collection, you’re on the right path with our online document editor. It’s simple and secure, requiring no specific technical expertise. Our web-based tool is designed to manage nearly everything related to document editing and completion.

Ditch the traditional methods of processing your forms. Opt for a more effective solution that aids in streamlining your tasks and reducing reliance on paper.

- Step 1. Locate the necessary document on our platform.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our advanced editing features that allow you to insert, delete, annotate, and emphasize or obscure text.

- Step 4. Generate and append a legally-recognized signature to your document by employing the signing option in the top toolbar.

- Step 5. If the document format doesn’t appear as you require, use the options on the right to eliminate, add more, and rearrange pages.

- Step 6. Include fillable fields so that other individuals can be invited to complete the document (if relevant).

- Step 7. Distribute or dispatch the document, print it out, or select the format in which you’d prefer to receive the file.

Get form

Related links form

The option to file Form 1040A has been removed at the federal level, but you can still utilize the IA DoR 1040A for your Iowa state taxes. This form allows you to report income and same deductions without the complexities of the longer forms. Ensure you meet the eligibility criteria before proceeding to file your state taxes with the IA DoR 1040A.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.