Loading

Get Mn Dor Compromise Application 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Compromise Application online

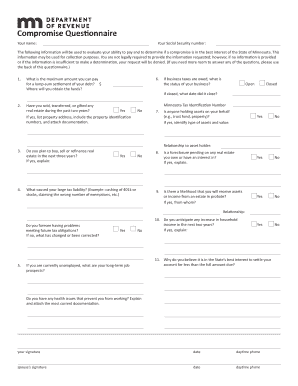

Navigating the MN DoR Compromise Application can seem overwhelming, but this guide will provide clear instructions for successfully completing the form online. Follow the steps below to ensure that you submit all necessary information correctly.

Follow the steps to fill out the MN DoR Compromise Application online.

- Click the ‘Get Form’ button to obtain the MN DoR Compromise Application and open it in your preferred form editor.

- Begin filling out the general information section, including your name and Social Security number, to establish your identity.

- Complete the compromise questionnaire by providing details about your financial situation. Make sure to give accurate information regarding income, debts, and any assets.

- Attach required documentation, such as verification of income, medical documentation, and proof of expenses according to the instructions on the application.

- If applicable, make sure both joint filers answer all questions, or request a Separation of Liability for debts if seeking a compromise individually.

- Review the information provided in each section to ensure accuracy before submission.

- Once all fields are completed and verified, save your changes. You can then download, print, or share the completed application as needed.

Begin your application process online today to secure a potential compromise on your tax obligations.

Related links form

We require you remove claims for deceased debtors before the statute of limitations for the debt expires. We recommend removing non-expired deceased debtor claims 3.5 years after the due date of the final tax return. Refunds will not apply after that time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.