Loading

Get Fl Dr-700025 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-700025 online

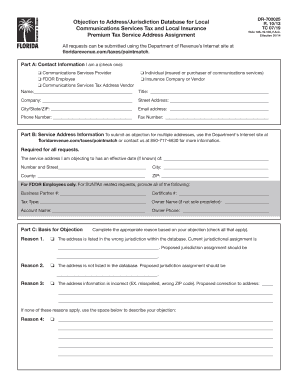

This guide will help you complete the FL DR-700025 form, which is used to object to address or jurisdiction assignments for local communications services tax and local insurance premium tax. By following this comprehensive and user-friendly approach, you can confidently fill out the form online.

Follow the steps to accurately complete the FL DR-700025 form.

- Press the 'Get Form' button to access the FL DR-700025 form and open it in your preferred editor.

- In Part A, provide your contact information. Select your status by checking one of the available options, which include communications services provider, FDOR employee, or individual insured or purchaser of communications services. Fill in your name, title, company, address, city/state/ZIP, email, phone number, and fax number as required.

- Move to Part B to input the service address information you are objecting to. Enter the effective date if you have this information and complete the fields for number and street, city, county, and ZIP code.

- For FDOR employees, complete additional fields such as the business partner number, certificate number, tax type, owner name (if applicable), account name, and owner phone number.

- In Part C, identify the basis for your objection. Check the appropriate reasons for your objection and provide detailed corrections in the space provided for each reason.

- In Part D, submit competent evidence as required. Check all applicable forms of evidence you are providing, such as a voter registration card or property tax bill, ensuring that items specifically for FDOR employees are included if relevant.

- Finally, in Part E, sign and date the form. Ensure that you have completed all necessary sections before proceeding.

- After completing the form, you can save your changes, download, print, or share the finished document as required.

Complete your FL DR-700025 form online for a smooth submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To acquire a Florida tax ID number, you will need to apply through the Florida Department of Revenue. You can complete the application online, providing necessary information about your business structure and ownership. This tax ID number is essential for tax compliance and business operations in Florida.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.